What is UPI ID: How to Create and Find UPI ID?

Discover what a UPI ID is and learn how to create and find your UPI ID with our comprehensive guide.

Since the advent of the UPI revolution in India, I've frequently encountered the question: What is a UPI ID?

In this blog, we will delve into the topic comprehensively and provide a detailed explanation.

UPI (Unified Payment Interface), regulated by the Reserve Bank of India (RBI), is a revolutionary system for immediate and cost-free fund transfers between two bank accounts through mobile applications.

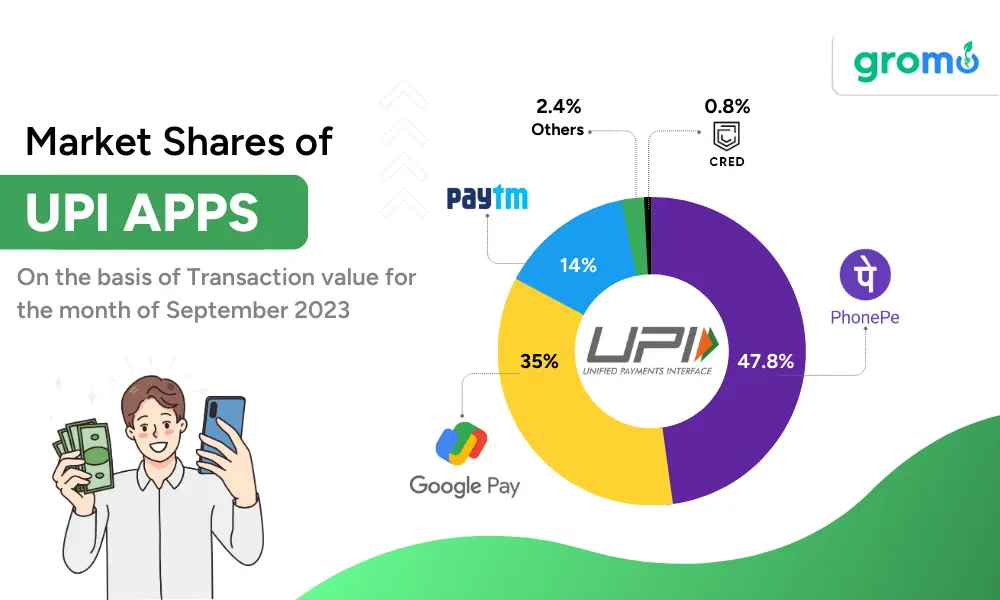

With a record-breaking 10.56 billion transactions in September 2023, UPI operates 24/7, simplifying transactions year-round.

Traditional methods like IMPS/NEFT are cumbersome, requiring extensive recipient information. In contrast, UPI payments demand only a UPI ID, mobile number, or QR code, unique to each user.

If you want to open a new UPI account, you can do it with GroMo and enjoy extra rewards!

UPI ID stands for Unified Payment Interface Identity, serving as a virtual payment address for seamless online transactions.

Launched in 2016, UPI has significantly transformed the payment landscape in India and is becoming a globally recognized payment system. UPI payment service has been embraced by countries including Singapore, the UAE, Nepal, Bhutan, France, and Sri Lanka.

What is the Full Form of UPI?

A UPI, which stands for Unified Payments Interface, is your key to swift money transfers between bank accounts through a single platform. With it, you can easily send and receive money by simply scanning a Quick Response (QR) code.

This comes in handy for shopping, bill payments, and authorizing transactions, making financial transactions a breeze.

What does UPI ID Mean?

A UPI ID is a crucial element in the UPI system. It serves as a virtual payment address (VPA) unique to each UPI user, simplifying digital transactions.

Your UPI ID is distinct from your bank account number and other confidential information. You can effortlessly create your UPI ID within UPI applications like Google Pay or PhonePe.

The UPI system enables seamless fund transfers without requiring account numbers or IFSC codes. Transactions are facilitated using the user's phone number and their UPI ID.

Also, check these out

How Many UPI Transactions Per Day?

According to the National Payments Corporation of India (NPCI), the number of UPI transactions per day in India crossed 35.2 million in September 2023.

This is a significant increase from the 10 million UPI transactions per day that were being processed in January 2023.

Get your new UPI account through GroMo and receive additional rewards!

What is UPI ID Example?

Think of your UPI ID as a unique virtual address for your bank account in India. It's like your personalized financial identity.

A UPI ID can come in different forms, making it easy to remember.

For instance,

- It could be your first name followed by your bank's initials,

such as Kalpit@oksbibank - Alternatively, it might start with your mobile number or email address and include your bank's name, like 807869951@bank

How to Create UPI ID?

We will answer how to create a UPI ID in the following section, walking you through each step of the process for different apps.

Creating a UPI ID is a breeze, offering a seamless way to send and receive funds securely.

With a UPI ID, you have a unique virtual payment address for your transactions.

In just a few simple steps, you can set up your UPI ID and unlock the convenience of hassle-free digital payments.

To generate a UPI ID, simply register your mobile number and bank account on UPI-enabled applications like PhonePe, Google Pay, Mobikwik, Paytm, and more.

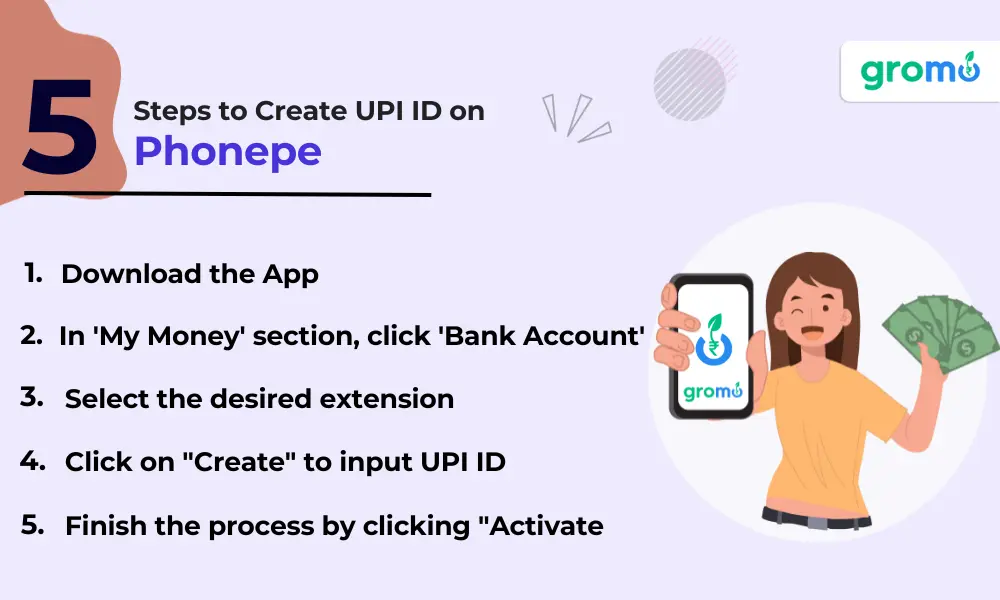

1. How to Create UPI ID on PhonePe

Creating a UPI ID in PhonePe is straightforward and can be done in a few easy steps:

Step 1: Start by downloading and opening the PhonePe app and completing the registration process.

Step 2: In the 'My Money' section, access 'Bank Accounts' under Payments, and then choose your bank account.

Step 3: Select the desired extension from the dropdown menu and tap the "+" sign next to it.

Step 4: Click on "Create" to input your chosen UPI ID.

Step 5: Finish the process by clicking "Activate."

That's it! You've successfully created your UPI ID in PhonePe and can start making digital transactions.

2. How to Create UPI ID on GooglePay

Here are the steps to create your UPI ID in Google Pay:

Step 1: Begin by downloading and launching the Google Pay app.

Step 2: Tap on your profile picture located in the top right corner.

Step 3: Select "Bank account."

Step 4: Choose the bank account you've linked to Google Pay.

Step 5: Click "Edit" next to 'UPI ID.'

Step 6: Hit the '+' button to generate your unique UPI ID.

You're all set! Your UPI ID is now ready in GooglePay, allowing you to initiate digital transactions without any hassle.

3. How to Create UPI ID on the BHIM App

Here are the steps to get started with the BHIM app:

Step 1: Begin by downloading the BHIM app from either the Google Play Store or the App Store.

Step 2: When you open the app, choose your preferred language and tap "Proceed." Make sure to grant the necessary permissions for SMS, calls, and location.

Step 3: The BHIM app will send an SMS from your phone to verify your mobile number.

Step 4: Once your mobile number is verified successfully, pick your bank from the provided list.

Step 5: The app will automatically retrieve your account number and IFSC linked to your mobile number. If you have multiple accounts linked to your number, select the one you want to use.

Step 6: Confirm your bank details and set up a secure 4 or 6-digit PIN for safe transactions.

You're good to go! Your UPI ID is now set up in BHIM, enabling you to effortlessly engage in digital transactions.

Also, check these out

Can You Link Multiple Accounts to Your UPI?

Yes, you have the flexibility to link multiple bank accounts to your UPI. This enables you to utilize a single UPI ID for both receiving and making payments through all of your connected bank accounts.

How to Find UPI ID?

If you are using a UPI-enabled app, you can easily find your UPI ID.

Here is a guide on how to find your UPI ID on different apps:

1. How to Find UPI ID on PhonePe?

To find your UPI ID on PhonePe, follow these steps:

- Open the PhonePe app.

- Tap on your profile picture in the top left corner of the screen.

- Tap on "UPI IDs" under the Payment Settings section.

- Your UPI ID will be displayed under your name and phone number.

2. How to Find UPI ID on GooglePay?

To find your UPI ID on Google Pay, follow these steps:

- Open the Google Pay app.

- Tap on your profile picture in the top right corner of the screen.

- Tap on "Bank accounts" and select the bank account for which you want to view the UPI ID.

- Your UPI ID will be displayed under the bank account information.

3. How to Find UPI ID on the BHIM App?

To find your UPI ID on the BHIM app, follow these steps:

- Open the BHIM app.

- Tap on the three horizontal lines in the top left corner of the screen.

- Select "Profile".

Your UPI ID will be displayed under your name and phone number.

Features and Benefits of UPI

-

Convenient: UPI is a single-window mobile payment system that allows users to link multiple bank accounts into a single smartphone app and make fund transfers without having to provide an IFSC code or account number.

-

Secure: UPI uses a two-factor authentication process to ensure the security of transactions.

-

Real-time: UPI transactions are processed in real-time, meaning that the money is transferred from the sender's account to the receiver's account immediately.

-

Versatile: UPI can be used to make payments both online and offline. It is accepted by a wide range of merchants and service providers, including government websites and apps.

-

Affordable: UPI transactions are free of charge for users.

Key Takeaways

- UPI (Unified Payments Interface) is a real-time payment system that allows users to transfer money between bank accounts using their smartphones.

- UPI ID is a unique virtual payment address for UPI users. You can use your UPI ID to send and receive money instantly from your bank account without sharing your account number or other details.

- According to NPCI, the number of UPI transactions per day in India crossed 35.2 million in September 2023

- To create a UPI ID, download a UPI-enabled app, link your bank account, and create a unique UPI ID.

- Yes, you can link multiple bank accounts to your UPI ID by adding them to your UPI-enabled app

- To find your UPI ID, open your UPI-enabled app and go to your profile. Your UPI ID will be displayed below your name and phone number.