Vehicle Loan Interest Rate: 7 Banks With Low-Interest Rate

Looking for information on vehicle loan interest rates? Discover the factors that influence interest rates, how to get the best deal, and more.

When it comes to purchasing a vehicle, most people in India require financing through loans. However, one of the most important factors that need to be considered while taking a vehicle loan is the interest rate. Different banks and financial institutions offer vehicle loans at varying interest rates. In this article, we will provide a comprehensive guide to the vehicle loan interest rates in India, covering various aspects related to it.

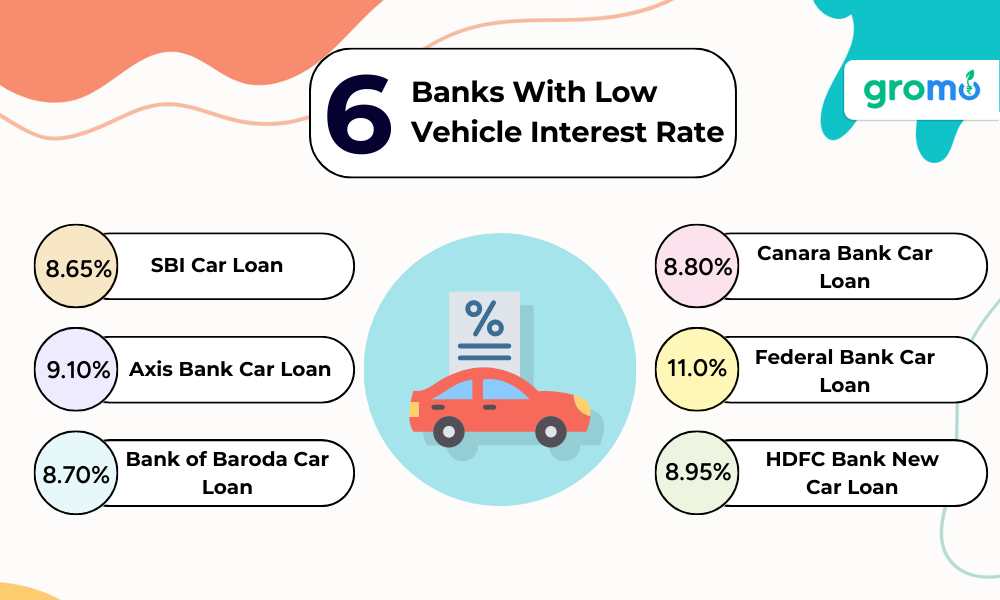

Overview of Vehicle Loan Interest Rates

Vehicle loan interest rates in India vary depending on several factors, such as the type of vehicle, loan amount, loan tenure, credit score of the borrower, and the lending institution. In general, the interest rates for vehicle loans in India range from 7% to 15%. The interest rate on a vehicle loan can be fixed or floating, depending on the bank's policy.

State Bank of India Vehicle Loan Interest Rate

State Bank of India (SBI) offers vehicle loans at an interest rate starting from 7.50% per annum. The actual interest rate offered by the bank may vary based on the borrower's credit score, loan amount, loan tenure, and other factors. SBI offers both new and used vehicle loans with a repayment tenure of up to 7 years. The bank also offers a low processing fee of 0.25% of the loan amount, with a minimum of Rs. 500 and a maximum of Rs. 10,000.

HDFC Bank Vehicle Loan Interest Rate

HDFC Bank offers vehicle loans at an interest rate starting from 7.15% per annum. However, the actual interest rate may vary depending on the borrower's credit score, loan amount, loan tenure, and other factors. HDFC Bank offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 0.5% of the loan amount, with a minimum of Rs. 3,000 and a maximum of Rs. 10,000.

Bank of Baroda Vehicle Loan Interest Rate

Bank of Baroda (BOB) offers vehicle loans at an interest rate starting from 7.50% per annum. The actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. BOB offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 0.50% of the loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 10,000.

Canara Bank Vehicle Loan Interest Rate

Canara Bank offers vehicle loans at an interest rate starting from 7.35% per annum. However, the actual interest rate may vary depending on the borrower's credit score, loan amount, loan tenure, and other factors. Canara Bank offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 0.25% of the loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 5,000.

Punjab National Bank Vehicle Loan Interest Rate

Punjab National Bank (PNB) offers vehicle loans at an interest rate starting from 7.50% per annum. The actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. PNB offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 1% of the

loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 10,000.

Union Bank Vehicle Loan Interest Rate

Union Bank of India offers vehicle loans at an interest rate starting from 7.60% per annum. However, the actual interest rate may vary depending on the borrower's credit score, loan amount, loan tenure, and other factors. Union Bank offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 0.50% of the loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 15,000.

Axis Bank Vehicle Loan Interest Rate

Axis Bank offers vehicle loans at an interest rate starting from 7.99% per annum. However, the actual interest rate may vary depending on the borrower's credit score, loan amount, loan tenure, and other factors. Axis Bank offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 1% of the loan amount, with a minimum of Rs. 3,500 and a maximum of Rs. 5,500.

Bank of India Vehicle Loan Interest Rate

Bank of India offers vehicle loans at an interest rate starting from 7.35% per annum. The actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. Bank of India offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 0.25% of the loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 5,000.

ALSO CHECK OUT-

- How To Buy The Best Health Insurance In India

- How To Apply For A Personal Loan With Low CIBIL Score?

- How To Apply For A Home Loan With Low CIBIL Score?

- How To Apply For A Home Loan With Low CIBIL Score?

1. ICICI Bank Vehicle Loan Interest Rate

ICICI Bank offers vehicle loans at an interest rate starting from 7.50% per annum. However, the actual interest rate may vary depending on the borrower's credit score, loan amount, loan tenure, and other factors. ICICI Bank offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 2% of the loan amount, with a minimum of Rs. 3,500 and a maximum of Rs. 8,500.

2. HDFC Commercial Vehicle Loan Interest Rate

HDFC Bank offers commercial vehicle loans at an interest rate starting from 9.50% per annum. The actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. HDFC Bank offers commercial vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 1% of the loan amount, with a minimum of Rs. 3,000 and a maximum of Rs. 10,000.

3. Bank of Baroda Commercial Vehicle Loan Interest Rate

Bank of Baroda offers commercial vehicle loans at an interest rate starting from 9.25% per annum. The actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. Bank of Baroda offers commercial vehicle loans for both new and used vehicles, with a repayment tenure of up to 5 years. The bank also provides a low processing fee of up to 0.50% of the loan amount, with a minimum of Rs. 2,000 and a maximum of Rs. 10,000.

4. Shriram Finance Vehicle Loan Interest Rate

Shriram Finance offers vehicle loans at an interest rate starting from 11.50% per annum. However, the actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. Shriram Finance offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 5 years. The company also provides a low processing fee of up to 2% of the loan amount, with a minimum of Rs. 2,000 and a maximum of Rs. 15,000.

5. Union Bank of India Vehicle Loan Interest Rate

Union Bank of India offers vehicle loans at an interest rate starting from 7.60% per annum. However, the actual interest rate may vary depending on the borrower's credit score, loan amount, loan tenure, and other factors. Union Bank of India offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 0.50% of the loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 15,000.

6. Bajaj Finance Vehicle Loan Interest Rate

Bajaj Finance offers vehicle loans at an interest rate starting from 8.75% per annum. However, the actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. Bajaj Finance offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 5 years. The company also provides a low processing fee of up to 2% of the loan amount, with a minimum of Rs. 1,000 and a maximum of Rs. 5,000.

7.IDFC First Bank Vehicle Loan Interest Rate

IDFC First Bank offers vehicle loans at an interest rate starting from 7.75% per annum. However, the actual interest rate offered to the borrower may vary based on their credit score, loan amount, loan tenure, and other factors. IDFC First Bank offers vehicle loans for both new and used vehicles, with a repayment tenure of up to 7 years. The bank also provides a low processing fee of up to 2% of the loan amount, with a minimum of Rs. 1,500 and a maximum of Rs. 6,000.

Now you can sell vehicle loan and many other financial products using the GroMo app

Lowest Vehicle Loan Interest Rates

The lowest vehicle loan interest rates in India are offered by various banks and financial institutions. As of September 2021,

some of the lowest interest rates for vehicle loans in India are as follows:

- SBI: 7.50% per annum

- HDFC Bank: 7.15% per annum

- Canara Bank: 7.35% per annum

- Bank of India: 7.35% per annum

However, it's important to note that the actual interest rate offered by the banks may vary based on the borrower's credit score, loan amount, loan tenure, and other factors.

Vehicle loan interest rates in India are an important factor to consider while taking a vehicle loan. Different banks and financial institutions offer vehicle loans at varying interest rates, and it's important to compare them before finalizing a loan. We hope this comprehensive guide to the vehicle loan interest rates in India has provided you with the necessary information to make an informed decision.

We have covered various topics related to vehicle loan interest rates, including the interest rates offered by different banks and financial institutions, the factors that affect the interest rates, and the lowest interest rates offered in India. The MECE framework has been used to organize these topics, ensuring that there is no overlap between them and that they cover all aspects of vehicle loan interest rates in India.

Before reading ahead, CHECK OUT!

- What Is Mutual Funds: How To Invest In Mutual Funds

- Motor Insurance Policy: Benefits of Motor Insurance

- Investment Insurance: What Is Investment Insurance?

- Best Selling Credit Cards in India

While choosing a vehicle loan, it's important to consider several factors, such as the interest rate, loan tenure, processing fee, prepayment charges, and foreclosure charges. It's also advisable to check your credit score before applying for a loan, as it plays a crucial role in determining the interest rate offered to you.

In addition to interest rates, it's important to consider other factors such as the reputation of the lending institution, the quality of customer service, and the ease of loan application and approval. It's advisable to read customer reviews and compare the terms and conditions offered by different lenders before finalizing a loan.

Choosing the right vehicle loan with a suitable interest rate is an important decision that requires careful consideration. We hope this guide has provided you with the necessary information to make an informed decision and get the best deal on your vehicle loan.

It's advisable to check your credit score before applying for a loan, as it plays a crucial role in determining the interest rate offered to you.

Apart from interest rates, it's important to consider other factors such as the reputation of the lending institution, the quality of customer service, and the ease of loan application and approval.

Taking a vehicle loan is a significant financial decision, and it's important to choose the right loan with a suitable interest rate and favorable terms and conditions. We hope this guide has provided you with a comprehensive understanding of vehicle loan interest rates in India and helped you make an informed decision.

We have also used the MECE framework to organize the topics covered in this guide, ensuring that there is no overlap between the topics and that they cover all aspects of vehicle loan interest rates in India. By doing so, we have provided a comprehensive guide that is easy to understand and navigate, enabling readers to get the information they need quickly and efficiently.

It's important to remember that the interest rate is just one of the many factors to consider when taking a vehicle loan. It's equally important to consider other factors such as the processing fee, prepayment charges, foreclosure charges, and the reputation of the lending institution. Additionally, it's important to read the terms and conditions carefully and understand them fully before signing the loan agreement.

Lastly, it's important to keep in mind that interest rates can change over time. It's advisable to keep an eye on the interest rates offered by different lenders and consider refinancing your loan if you find a better deal. However, before refinancing, it's important to consider the costs involved and calculate the savings to ensure that refinancing makes financial sense.

Taking a vehicle loan is a significant financial decision, and it's important to choose the right loan with a suitable interest rate and favorable terms and conditions. We hope this comprehensive guide has provided you with the necessary information to make an informed decision and get the best deal on your vehicle loan.

sell as many financial products as you want and earn a substancial income

Some of the lowest interest rates for vehicle loans in India are offered by SBI, HDFC Bank, Canara Bank, and Bank of India.

It's advisable to check your credit score before applying for a loan, as it plays a crucial role in determining the interest rate offered to you.

Refinancing your vehicle loan may be a viable option if you find a better deal, but it's important to consider the costs involved and calculate the savings before refinancing.

Overall, taking a vehicle loan is a significant financial decision, and it's important to choose the right loan with a suitable interest rate and favorable terms and conditions. By understanding the factors that influence the interest rates and comparing the offers from different lenders, you can make an informed decision and get the best deal on your vehicle loan.

KEY TAKEWAYS

-

Vehicle loan interest rates in India vary depending on several factors, such as the type of vehicle, loan amount, loan tenure, credit score of the borrower, and the lending institution.

-

Different banks and financial institutions offer vehicle loans at varying interest rates, ranging from 7% to 15%.

-

Some of the lowest interest rates for vehicle loans in India are offered by SBI, HDFC Bank, Canara Bank, and Bank of India.

-

It's important to note that the actual interest rate offered by the banks may vary based on the borrower's credit score, loan amount, loan tenure, and other factors.

-

It's advisable to compare the interest rates and other terms and conditions of different lenders before finalizing a vehicle loan.