Top Providers of Life Insurance: 4 Best Providers In India

Top Providers of Life Insurance: 4 Best Providers In India. When it comes to safeguarding your financial future and protecting your loved ones.

When it comes to safeguarding your financial future and protecting your loved ones, life insurance plays a crucial role. Life insurance provides financial security and peace of mind by ensuring that your loved ones are taken care of in the event of your untimely demise.

With numerous insurance providers in India, it's important to choose a reliable and trustworthy company that offers comprehensive coverage and excellent customer service. In this article, we will explore the top five providers of life insurance in India, highlighting their key features and offerings to help you make an informed decision.

1. Life Insurance Corporation of India (LIC)

As the largest and most trusted life insurance company in India, LIC has been a market leader for decades. Established in 1956, LIC has a vast customer base and a wide range of insurance products to cater to different needs. Here are some reasons why LIC stands out:

Wide Range of Plans: LIC offers a diverse portfolio of life insurance plans, including term plans, endowment plans, money-back plans, whole life plans, and more. This ensures that customers have ample options to choose from based on their financial goals and requirements.

High Claim Settlement Ratio: LIC boasts an impressive claim settlement ratio, indicating its commitment to honoring claims and providing prompt assistance to policyholders during difficult times.

Pan-India Presence: With a widespread network of branches and agents across the country, LIC ensures easy accessibility and personalized service to policyholders.

CHECK OUT NOW!

- Personal Loan Terms And Definitions: Exhaustive List

- Life Insurance Terms And Definitions: Exhaustive List

- Top Providers Of Investment Insurance: 10 Providers List

- Savings Account Terms And Definitions: Exhaustive List

2. HDFC Life Insurance

HDFC Life Insurance is a leading private life insurance provider in India known for its customer-centric approach and innovative product offerings. Here's why HDFC Life is among the top providers:

Variety of Plans: HDFC Life offers a wide array of insurance plans, including term plans, savings and investment plans, retirement plans, and health plans. This allows customers to select the most suitable plan as per their needs and financial goals.

Customer-Centric Approach: HDFC Life emphasizes customer satisfaction by providing efficient claim settlement processes, digital platforms for policy management, and responsive customer support services.

Strong Financial Performance: HDFC Life has consistently demonstrated robust financial performance and stability, assuring policyholders of the company's ability to fulfill its commitments.

3. SBI Life Insurance

SBI Life Insurance is a joint venture between the State Bank of India (SBI) and BNP Paribas Cardif, a renowned global insurance company. With the backing of India's largest public sector bank, SBI Life stands as a trusted choice for life insurance. Here are its key highlights:

Diverse Product Range: SBI Life offers a comprehensive range of insurance plans, including term plans, unit-linked plans, child plans, pension plans, and group plans. This caters to the diverse needs and preferences of customers.

Excellent Customer Service: SBI Life places a strong emphasis on customer service, ensuring a smooth experience for policyholders. The company provides multiple channels for customer support and grievance redressal.

Digital Initiatives: SBI Life has invested in digital platforms, enabling customers to access policy information, make online payments, and track policy performance conveniently.

4. ICICI Prudential Life Insurance

ICICI Prudential Life Insurance is a leading private life insurance provider that offers a wide range of life insurance solutions. The company is a collaboration between ICICI Bank, a prominent private sector bank, and Prudential Corporation Holdings Limited, a global financial services group. Consider the following aspects of ICICI Prudential Life:

Innovative Plans: ICICI Prudential Life offers innovative and customizable life insurance plans, including term plans, savings and investment plans, child

plans, retirement plans, and health plans. These plans cater to different life stages and financial goals, allowing customers to choose the most appropriate coverage.

Strong Investment Expertise: With the backing of ICICI Bank and Prudential Corporation Holdings Limited, ICICI Prudential Life leverages its investment expertise to offer investment-linked insurance plans that provide potential for wealth creation along with life coverage.

Digital Solutions: ICICI Prudential Life has embraced digitalization, offering online platforms and mobile apps for seamless policy management, premium payments, and claims processing. This enhances convenience and accessibility for policyholders.

Transparency and Ethics: ICICI Prudential Life emphasizes transparency and ethical practices, ensuring that policyholders are well-informed about the terms and conditions of their policies. The company strives to maintain the highest standards of integrity in its operations.

Max Life Insurance

Max Life Insurance is a renowned private life insurance company known for its customer-centric approach and comprehensive product offerings. Consider the following factors that make Max Life Insurance a top provider in India:

Comprehensive Insurance Solutions: Max Life Insurance offers a wide range of insurance plans, including term plans, savings plans, child plans, retirement plans, and group plans. These plans cater to various needs and provide comprehensive coverage.

Customer-Focused Initiatives: Max Life Insurance focuses on providing an excellent customer experience by offering personalized solutions, quick claims settlement, and responsive customer support through various channels.

Strong Financial Performance: Max Life Insurance boasts a strong financial track record, reflecting its stability and commitment to fulfilling its obligations towards policyholders.

Innovative Offerings: Max Life Insurance introduces innovative insurance solutions such as term plans with return of premium, which provide financial protection as well as the return of premiums paid on policy maturity.

Digital Enablement: Max Life Insurance has embraced digitalization to enhance customer convenience. The company provides digital platforms for policy management, premium payment, and accessing policy-related information.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

Choosing the right life insurance provider is a crucial decision that requires careful consideration. The top providers mentioned in this article, including LIC, HDFC Life Insurance, SBI Life Insurance, ICICI Prudential Life Insurance, and Max Life Insurance, have established themselves as industry leaders by offering a combination of diverse product offerings, excellent customer service, strong financial performance, and innovative solutions.

It's essential to assess your individual needs, financial goals, and preferences before making a final decision. Consulting with a financial advisor can also provide valuable guidance in selecting the best life insurance provider that aligns with your requirements. Remember, life insurance is a long-term commitment, and choosing a reputable provider ensures peace of mind and financial security for you and your loved ones.

From the comparison table above, it is evident that all the top providers have their unique strengths and offerings. LIC, being the largest life insurance company in India, provides an extensive range of plans and has a wide network for customer service. HDFC Life Insurance stands out for its customer-centric approach and strong financial performance.

SBI Life Insurance, with its association with State Bank of India, offers diverse plans and emphasizes customer service. ICICI Prudential Life Insurance focuses on innovative plans and transparent practices. Max Life Insurance is known for its comprehensive offerings and customer-centric initiatives.

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

When selecting a life insurance provider, it's crucial to consider your specific requirements, financial goals, and risk appetite. Additionally, factors such as premium affordability, coverage options, and the reputation of the insurance company should also be taken into account. Consulting with a financial advisor can help in assessing your needs and selecting the provider that best aligns with your requirements.

Remember, life insurance is a long-term commitment, and choosing a reliable and trustworthy provider ensures that your loved ones are financially protected in your absence.

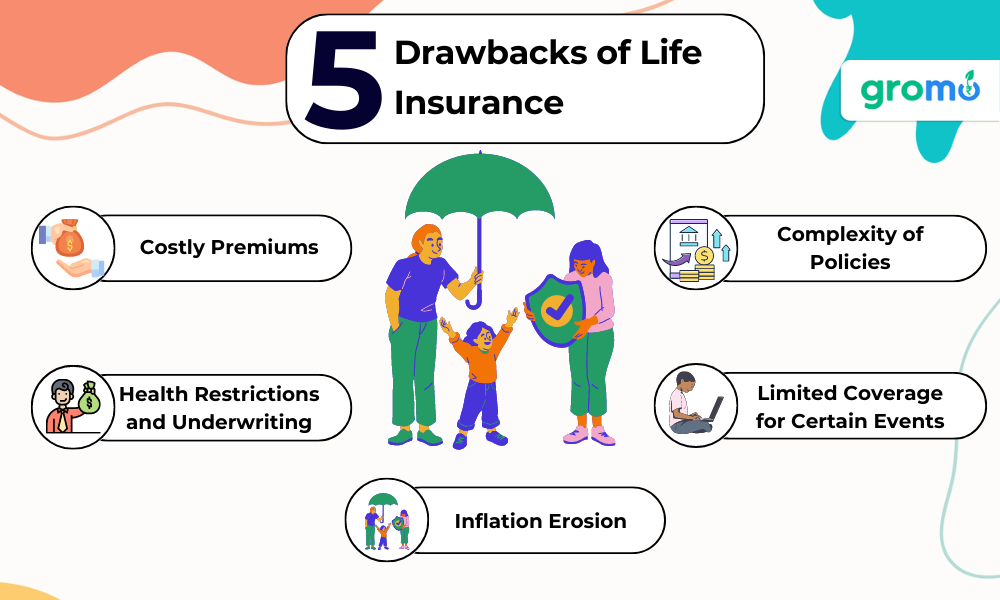

Life insurance is undoubtedly a valuable financial tool that offers protection and peace of mind to policyholders and their loved ones. However, like any other financial product, it is important to consider the drawbacks and limitations associated with life insurance.

Let's explore some of the common drawbacks:

-

Costly Premiums: One of the significant drawbacks of life insurance is the cost associated with it. Life insurance premiums can be quite expensive, especially for policies that offer higher coverage or include additional features such as investment components. This can make it challenging for individuals on tight budgets to afford adequate coverage.

-

Complexity of Policies: Life insurance policies can be complex and difficult to understand, especially for individuals who are not well-versed in financial matters. The terminology and fine print of policies can be overwhelming, making it challenging for policyholders to grasp the details of their coverage and the associated terms and conditions.

-

Health Restrictions and Underwriting: Life insurance policies often require applicants to undergo a medical examination and disclose their health history. Individuals with pre-existing medical conditions or those considered high-risk may face challenges in obtaining affordable coverage or may even be denied coverage altogether. This can limit the accessibility of life insurance for certain individuals.

-

Limited Coverage for Certain Events: Life insurance primarily covers death-related risks, providing financial protection to beneficiaries in case of the policyholder's demise. However, certain events such as disability, critical illness, or long-term care may not be adequately covered under standard life insurance policies. Additional riders or separate policies may be required to address these specific needs.

-

Policy Lapses and Surrender Penalties: Life insurance policies require regular premium payments to stay active. If policyholders fail to pay premiums, their policies may lapse, resulting in the loss of coverage and potential financial loss. Additionally, surrendering a life insurance policy before its maturity can result in surrender penalties and limited returns, affecting the policyholder's financial goals.

-

Investment Risks in Some Policies: Certain types of life insurance policies, such as investment-linked insurance plans or unit-linked insurance plans, combine life coverage with an investment component. While these policies offer potential for wealth creation, they also expose policyholders to investment risks, such as market volatility and the potential for loss of principal.

-

Limited Flexibility and Changing Needs: Life insurance policies are typically long-term commitments, and altering the coverage or surrendering the policy may result in financial penalties or loss of benefits. This lack of flexibility can be a drawback for individuals whose financial needs or circumstances change over time.

-

Inflation Erosion: Over time, the value of the life insurance coverage may be eroded by inflation. The sum assured, which may seem substantial at the time of policy purchase, may not provide the same level of financial protection years later due to rising costs and inflationary pressures.

CHECK OUT NOW!!

Investment Products Terms And Definitions: Exhaustive List

Motor Insurance Terms And Definitions: Exhaustive List

Term Life Insurance Meaning: Types, Pros, Cons, And More

Top Providers Of Vehicle Loans: 5 Providers In India

KEY TAKEAWAYS

-

Importance of Life Insurance: Life insurance is a crucial financial tool that provides protection and financial security to individuals and their families in the event of unforeseen circumstances such as death or disability.

-

Diverse Policy Offerings: The top providers of life insurance in India, including LIC, HDFC Life Insurance, SBI Life Insurance, ICICI Prudential Life Insurance, and Max Life Insurance, offer a wide range of policy options catering to various needs, including term plans, savings and investment plans, retirement plans, and more.

-

Claim Settlement Ratio: It is essential to consider the claim settlement ratio of an insurance company before choosing a provider. The mentioned providers have a high claim settlement ratio, indicating their commitment to promptly settling claims and providing financial support to policyholders' beneficiaries.

-

Customer Service and Digital Capabilities: The top life insurance providers prioritize customer service and leverage digital solutions to enhance convenience for policyholders. They offer personalized assistance, multiple channels for support, and user-friendly digital platforms for policy management, premium payments, and accessing policy-related information.

-

Individual Considerations: When selecting a life insurance provider, individuals should evaluate their specific requirements, financial goals, and risk appetite. Factors such as premium affordability, coverage options, financial stability of the provider, and reputation should be carefully considered. Consulting with a financial advisor can provide valuable guidance in choosing the most suitable life insurance provider.

GroMo Insure - A Brand of Vitrak Technologies Pvt. Ltd