Mutual Funds Meaning: Related Terms Explained

The purpose of this guide is to explain mutual funds meaning, their worth, what they are used for, their types, and the key factors to consider.

Investing in today's financial landscape has become increasingly popular for individuals seeking to build wealth and achieve long-term financial goals. Among the various investment options available, mutual funds have gained significant traction.

This comprehensive guide aims to provide an in-depth understanding of mutual funds meaning, it's benefits, types, and key considerations. Whether you're an experienced investor or someone exploring investment opportunities, this article will equip you with valuable insights into the world of mutual funds.

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products.

Mutual Funds Meaning - What Is It?

At its core, a mutual fund is a professionally managed investment vehicle that pools money from multiple investors to create a diversified portfolio of securities. These securities can include stocks, bonds, or a combination of both. The primary objective of a mutual fund is to maximize returns while minimizing risks.

Experienced fund managers are responsible for making investment decisions on behalf of the investors. Each investor in a mutual fund owns shares, which represent a portion of the fund's holdings.

Also, Check Out: Investment Products Meaning: A Comprehensive Guide

Benefits of Investing in Mutual Funds

Investing in mutual funds offers several advantages that make them an attractive option for many investors. Let's explore some of the key benefits:

1. Diversification:

Mutual funds enable investors to gain exposure to a diversified portfolio of securities. By spreading investments across various asset classes and industries, mutual funds help mitigate the risk associated with investing in individual stocks or bonds.

This diversification reduces the impact of any single investment's performance on the overall portfolio.

2. Professional Management:

One of the significant advantages of mutual funds is the expertise provided by professional fund managers. These managers possess in-depth knowledge of the financial markets and employ their skills to make informed investment decisions on behalf of the fund's investors.

Their expertise can potentially lead to higher returns and better risk management

3. Liquidity:

Mutual funds offer high liquidity, allowing investors to buy or sell their shares on any business day. This flexibility provides investors with the opportunity to access their funds whenever needed.

Unlike certain other investment options that may have restrictions or longer settlement periods, mutual funds offer ease of access to invested capital.

4. Affordability:

Mutual funds are available at various price points, making them accessible to a wide range of investors. With options to invest small or large amounts, individuals can start investing in mutual funds with relatively low initial investments.

This accessibility allows more people to participate in the financial markets without requiring substantial capital.

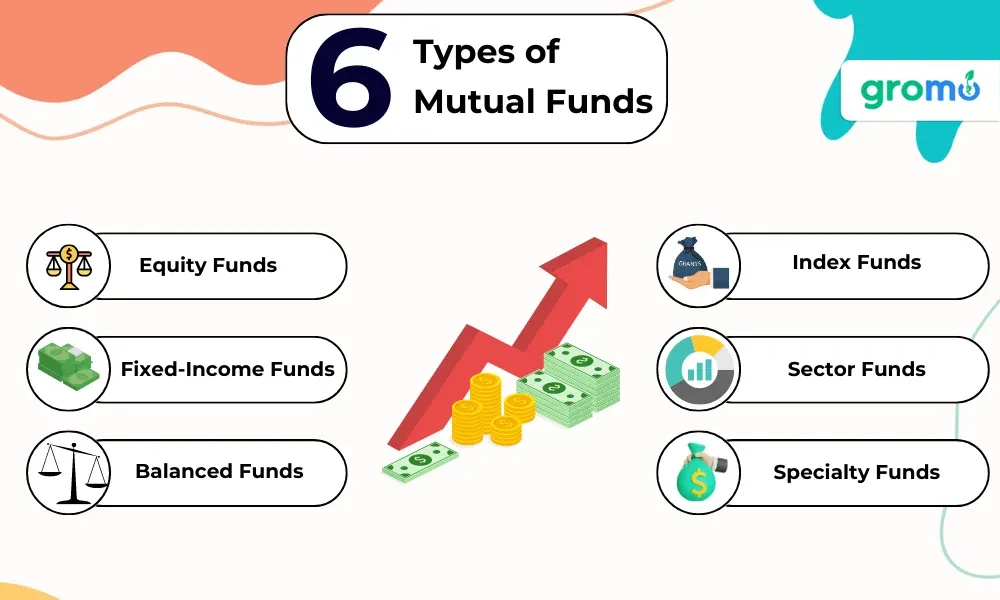

Types of Mutual Funds

Mutual funds can be categorized based on their investment objectives, asset classes, or other defining characteristics. Here are some of the most common mutual funds:

1. Equity Mutual Funds Meaning

Equity mutual funds primarily invest in stocks or equity securities, aiming for long-term capital appreciation. These funds may focus on specific sectors, market capitalizations (large-cap, mid-cap, or small-cap), or follow a broader market index.

2. Fixed Income Mutual Funds Meaning

Fixed-income funds primarily invest in fixed-income securities such as government bonds, corporate bonds, or treasury bills. These funds aim to provide a steady income stream and preserve capital.

3. Balanced Mutual Funds Meaning

Balanced funds, also known as hybrid funds, invest in a mix of equities and fixed-income securities. The asset allocation may vary based on the fund's investment strategy, balancing growth potential with income generation.

4. Index Mutual Funds Meaning

Index funds aim to replicate the performance of a specific market index, such as the S&P BSE 500. These funds invest in the same securities and the same proportion as the underlying index, providing investors with broad market exposure at a relatively low cost.

5. Sector Mutual Funds Meaning

Sector funds invest in industries or sectors, such as tech, health care, or energy. These funds allow investors to focus on a particular sector they believe will outperform the broader market.

6. Money Market Mutual Funds Meaning

Money Market Mutual Funds invest in securities that are short-term and low-risk. For example, Money Market Mutual Funds invest in treasury bills, certificates of deposit, and commercial paper. These funds aim to provide stability and preserve capital, making them suitable for investors seeking liquidity and capital preservation.

7. International Mutual Funds Meaning

International funds invest in securities outside the investor's home country. They provide exposure to global markets, allowing investors to diversify their portfolios and potentially benefit from the growth of international economies.

8. Target Date Mutual Funds Meaning

Target date funds, also known as lifecycle funds, are designed to align with a specific retirement or investment goal. These funds automatically change their asset mix over time and become less risk-averse as their target date approaches.

They provide a convenient option for investors with specific time horizons.

9. Specialty Mutual Funds Meaning

Specialty funds focus on niche areas or specific investment themes. Examples include socially responsible funds that invest in companies with ethical practices or environmental funds that prioritize environmentally sustainable businesses. These funds cater to investors who want to align their investments with their values or support specific causes.

10. Debt Mutual Funds Meaning

A debt fund is a mutual fund that invests in fixed-income securities such as bonds and treasury bills. Gilt funds, monthly income plans (MIPs), short-term plans (STPs), liquid funds, and fixed maturity plans (FMPs) are some options available as part of debt mutual funds.

When investing in mutual funds, there are several important factors to consider:

1. Risk Tolerance:

Understand your risk tolerance and investment goals. Different mutual funds carry varying levels of risk, and it's crucial to align your investment choices with your comfort level.

2. Expense Ratios:

Consider the expense ratio of the mutual funds you're interested in. This ratio represents the percentage of assets deducted annually to cover fund expenses. Lower expense ratios are generally favorable, as they leave more of your investment's returns in your pocket.

3. Past Performance:

While past performance doesn't guarantee future results, reviewing a fund's historical performance can provide insights into its track record. Compare the fund's performance against its benchmark and peer group to evaluate its consistency and potential.

4. Fund Management:

Research the fund manager's experience, expertise, and investment approach. A skilled and experienced fund manager can play a crucial role in the fund's performance and adherence to its investment objectives.

5. Investment Horizon:

Consider your investment horizon and match it with the fund's objectives. Some funds may be better suited for long-term goals, while others may cater to short-term objectives.

6. Fees and Expenses:

Understand the various fees associated with investing in mutual funds, including sales loads, redemption fees, and transaction costs. These fees can impact your overall returns, so it's important to assess them before investing.

7. Tax Implications:

Make sure to take a look at the tax implications of mutual funds. Some funds may generate taxable distributions, while others may offer tax advantages, such as municipal bond funds that provide tax-exempt income.

Mutual funds are versatile investment vehicles that offer numerous benefits to investors. Through diversification, professional management, liquidity, and affordability, mutual funds provide a viable option for individuals seeking to grow their wealth.

Understanding the various types of mutual funds and considering key factors like risk tolerance, expense ratios, and fund management can help investors make informed investment decisions. By harnessing the power of mutual funds, individuals can embark on a path towards achieving their financial goals with confidence and clarity.

Also Check Out: What Are Mutual Funds In Less Than 1 Minute

Glossary

Before concluding this comprehensive guide on mutual funds, let's define some key terms to ensure a complete understanding of the subject:

1. Asset Allocation Meaning In Mutual Fund

The distribution of investments across different asset classes, such as stocks, bonds, and cash equivalents, within a portfolio.

2. Benchmark Meaning In Mutual Fund

A reference point used to assess the performance of a mutual fund. It can be a market index or a group of similar funds.

3. Load Fee Meaning In Mutual Fund

A sales charge or commission is applied when buying or selling mutual fund shares. Load fees can be front-end loads (charged at the time of purchase) or back-end loads (charged when selling shares).

4. Net Asset Value (NAV) Meaning In Mutual Fund

NAV meaning in mutual funds is the price per share of a mutual fund calculated at the end of each trading day. This Net Asset Value (NAV) is determined by dividing the total value of the fund's assets by the number of outstanding shares.

5. Prospectus Meaning In Mutual Fund

A legal document that provides comprehensive information about a mutual fund, including its investment objectives, strategies, risks, fees, and historical performance. It is recommended that investors read the prospectus carefully before making a decision.

6. Redemption Meaning In Mutual Fund

The process of selling mutual fund shares and converting them back into cash. Investors can redeem their shares either partially or in full.

7. Systematic Investment Plan (SIP) Meaning In Mutual Fund

A method of investing in mutual funds that involves regularly investing a fixed amount at predetermined intervals, regardless of market conditions. SIPs encourage disciplined investing.

8. Volatility Meaning In Mutual Fund

The degree of variation or fluctuation in the price of a mutual fund's shares. Higher volatility indicates greater price fluctuations, which may imply higher risk.

9. XIRR Meaning In Mutual Fund

XIRR stands for 'Extended Internal Rate of Return'. XIRR in mutual funds means to estimate the return on investments where multiple transactions are executed at different time points.

10. Systematic Withdrawal Plan (SWP) Meaning In Mutual Fund

An SWP is a feature of mutual funds that allows the investor to withdraw a predetermined amount of money from his or her mutual fund investment on a monthly or quarterly basis.

11. Income Distribution Cum Capital Withdrawal (IDCW) Meaning In Mutual Fund

IDCW option allows you to draw income from your investments on a regular basis. Choosing the Income Distribution Cum Capital Withdrawal mutual fund options depends on your risk tolerance, objectives, and income stream.

It's important to note that investing in mutual funds carries inherent risks, and individuals should carefully assess their own financial situation and goals before making any investment decisions. Consulting with a qualified financial advisor can provide personalized guidance and ensure investments align with individual needs.

Remember, this comprehensive guide serves as a starting point for understanding mutual funds. As with any investment, it's crucial to stay informed, regularly review portfolio performance, and adapt strategies as needed to maximize long-term investment success.

To sell financial products like credit cards, personal loans, savings accounts, and many other products DOWNLOAD GroMo. The GroMo App is where you can sell and earn a substantial income sitting at home.

Key Takeaways

-

Mutual funds are professional investment vehicles that invest money from multiple investors in a portfolio of securities.

-

Investing in mutual funds offers several benefits like diversification, professional management expertise, liquidity, and affordability.

-

Different mutual funds cater to various investment objectives like equity mutual funds focus on stocks, fixed-income funds invest in bonds, etc.

-

Key considerations for mutual fund investors include risk tolerance, expense ratios, past performance, fund management, etc.

-

Investors should review the prospectus and consult with a financial advisor to gain a comprehensive understanding of mutual funds.