Motor Insurance: What Is Motor Insurance?

Looking for motor insurance? Protect your car and yourself with the right policy. Compare quotes from top insurers and find the best coverage for you.

Motor insurance, also known as car insurance or auto insurance, is a type of insurance policy that provides financial protection to vehicle owners against various risks associated with owning and operating a motor vehicle. In India, it is mandatory for all vehicle owners to have at least a basic third-party motor insurance policy.

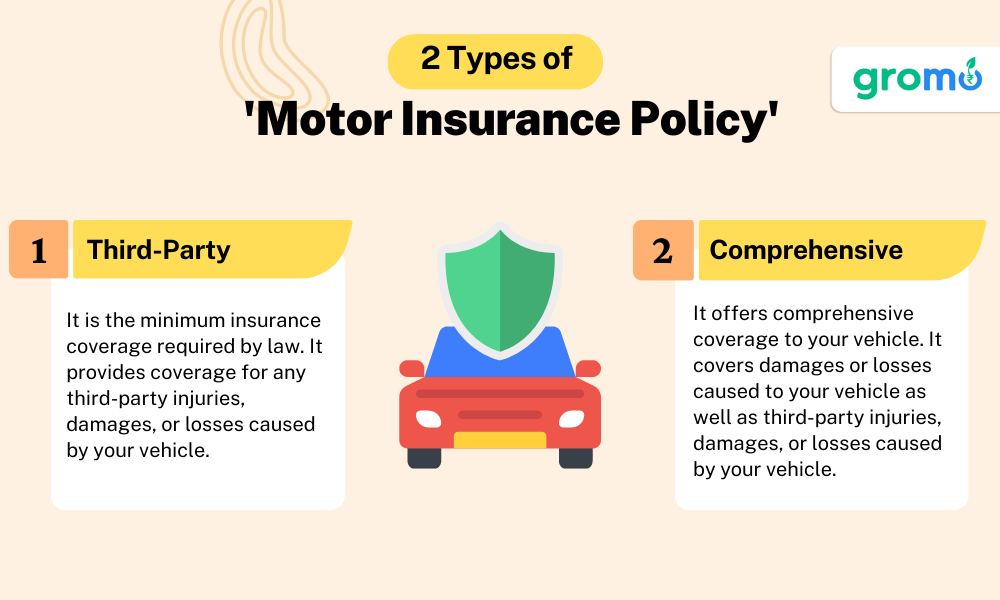

Types of Motor Insurance

There are two main types of motor insurance policies:

-

Third-Party Liability Insurance: This type of insurance covers the vehicle owner against any legal liability arising out of damage caused to a third party, including bodily injury or death, and damage to property. It does not cover any damage to the insured vehicle.

-

Comprehensive Insurance: This type of insurance provides coverage against damage or loss to the insured vehicle as well as any legal liability arising out of damage caused to a third party.

Motor Insurance Coverage

A comprehensive motor insurance policy typically covers the following:

Damage to the insured vehicle due to accidents, theft, fire, natural calamities, or malicious acts.

Personal accident cover for the owner-driver

Legal liability arising out of damage caused to a third party, including bodily injury or death, and damage to property.

Optional add-ons like engine protection, zero depreciation cover, and roadside assistance

Top Motor Insurance Companies in India.

Here are some of the top motor insurance companies in India:

- ICICI Lombard Motor Insurance

- Bajaj Allianz Motor Insurance

- Tata AIG Motor Insurance

- HDFC Ergo Motor Insurance

- Aditya Birla Motor Insurance

- Bharti AXA Motor Insurance

- Reliance Motor Insurance

- SBI Motor Insurance

- Bajaj Motor Insurance

- Future Generali Motor Insurance

- Benefits of Motor Insurance

You can get access to these motor insurance and many other insurances and earn by selling many more financial prodcuts easily.

Having a motor insurance policy provides the following benefits:

Financial protection against unexpected events like accidents, theft, or damage to the vehicle

Compliance with legal requirements for vehicle owners

Peace of mind knowing that you are covered against any unforeseen events.

Motor Insurance Renewal

Motor insurance policies need to be renewed annually. Most insurance companies provide the option of renewing the policy online, which is a quick and convenient way to renew the policy.

Motor Insurance Calculator

A motor insurance calculator is a tool that helps vehicle owners calculate the premium for their motor insurance policy. It takes into account factors like the make and model of the vehicle, the age of the vehicle, and the location of the vehicle to calculate the premium.

Motor insurance is an essential requirement for all vehicle owners in India. It provides financial protection against unexpected events and legal liabilities. Understanding the different types of motor insurance policies, coverage options, and add-ons is important in choosing the right policy that meets your needs.

When selecting an insurance company, it is important to consider factors like

- Reputation

- Customer service

- Claim settlement process.

Additionally, it is important to note that motor insurance policies are not one size fits all. The coverage and premium rates may vary based on the type of vehicle, the age of the vehicle, the location of the vehicle, and the usage of the vehicle. Therefore, it is important to carefully evaluate your needs and budget when selecting a motor insurance policy.

Go check out!!

- Need Guidance In Buying Health Insurance - GroMo Might Be The Solution

- How To Become A GroMo Partner And Sell Insurance Policies And Earn?

- Earn Money Online By Selling Insurance Online

- Is GroMo Real or Fake?

In case of any damage to the insured vehicle or any legal liability arising out of damage caused to a third party, the vehicle owner needs to file a claim with the insurance company. Most insurance companies have a streamlined claim settlement process that involves minimal documentation and quick settlement of claims.

It is also important to note that renewing the motor insurance policy before the due date is crucial to avoid any lapse in coverage. Driving without valid motor insurance is not only illegal but also exposes the vehicle owner to various risks.

Motor insurance is a necessary requirement for all vehicle owners in India. With a wide range of options available in the market, it is important to choose a policy that provides adequate coverage and meets your budget. Regularly renewing the policy and filing claims in a timely manner can ensure a hassle-free experience in case of any unforeseen events.

When it comes to selecting the best motor insurance company in India, there are several factors to consider such as coverage options, premium rates, claim settlement process, and customer service. Some of the top motor insurance companies in India are ICICI Lombard, Bajaj Allianz, HDFC Ergo, Tata AIG, Aditya Birla, Bharti AXA, and Reliance. It is recommended to compare the offerings of multiple insurers and read reviews before making a decision.

With the advent of digital technology, purchasing motor insurance online has become a popular option. Online purchase not only saves time and effort but also offers several benefits such as comparing policies, availing discounts, and easy renewal. Most insurance companies also have mobile apps that allow users to purchase and manage their policies on the go.

It is important to be aware of the various terms and jargon associated with motor insurance. Some of the commonly used terms are IDV (Insured Declared Value), NCB (No Claim Bonus), deductible, third-party liability, comprehensive coverage, and add-ons. Understanding these terms can help in making an informed decision and avoiding any confusion at the time of claim settlement.

Selecting the right policy, renewing it in a timely manner, and filing claims as per the process can ensure a hassle-free experience. With the availability of a wide range of options and the convenience of online purchase, buying motor insurance has become easier than ever before.

There are several top motor insurance companies in India such as

- ICICI Lombard,

- Bajaj Allianz,

- HDFC Ergo, Tata AIG,

- Aditya Birla, Bharti AXA,

- Reliance

It is recommended to compare the offerings of multiple insurers and read reviews before making a decision.

It is recommended that vehicle owners regularly renew their motor insurance policy to avoid any lapses in coverage. Most insurance companies offer online renewal options that can be done in a few simple steps. It is also important to ensure that the policy details are updated and accurate at the time of renewal.

In addition to the mandatory third-party liability insurance, vehicle owners can opt for additional add-ons that offer more extensive coverage. Some common add-ons include zero depreciation cover, engine protection cover, personal accident cover, and roadside assistance cover. These add-ons can provide enhanced protection and peace of mind in case of any unforeseen events.

When selecting a motor insurance policy, it is important to understand the coverage details and limitations of the policy. Some common exclusions in motor insurance policies include damage caused by a driver without a valid license, damage caused by driving under the influence of alcohol or drugs, and damage caused by intentional or criminal acts.

Motor insurance is a crucial aspect of vehicle ownership in India that provides financial protection and legal compliance. With the availability of a wide range of options and the convenience of online purchase and renewal, selecting the right policy and insurer has become easier than ever before.

Understanding the various terms and jargon associated with motor insurance and regularly renewing the policy can ensure a hassle-free experience in case of any unforeseen events.

It is also important to note that motor insurance is not just limited to cars, but also covers other types of motor vehicles such as two-wheelers, commercial vehicles, and agricultural vehicles. Each type of vehicle may have its own specific insurance requirements and coverage options.

In addition to offering financial protection and legal compliance, motor insurance also plays a crucial role in promoting road safety and responsible driving. Insurance companies often partner with government bodies and non-profit organizations to promote road safety awareness and offer training programs for drivers. This can help reduce the incidence of accidents and claims, leading to lower premiums and a safer driving environment for everyone.

Finally, it is important to note that insurance fraud is a major concern in the motor insurance industry in India. This includes cases of staged accidents, false claims, and inflated repair bills. Insurance companies have implemented various measures such as online verification of claims and partnering with law enforcement agencies to combat insurance fraud. It is important for vehicle owners to be aware of such fraudulent activities and report any suspicious behavior to the relevant authorities.

Motor insurance is an essential aspect of vehicle ownership in India that provides financial protection and legal compliance. With the availability of a wide range of options and the convenience of online purchase and renewal, selecting the right policy and insurer has become easier than ever before. Regular renewal of the policy and understanding the coverage details can ensure a hassle-free experience in case of any unforeseen events.

Moreover, motor insurance also serves as a tool for promoting road safety and responsible driving. By partnering with government bodies and non-profit organizations, insurance companies can offer training programs for drivers and promote road safety awareness.

This can help reduce the incidence of accidents and claims, leading to lower premiums and a safer driving environment for everyone.

It is also worth noting that motor insurance fraud is a major concern in the industry. Fraudulent activities such as staged accidents, false claims, and inflated repair bills can result in significant financial losses for insurance companies and policyholders.

To combat insurance fraud, insurance companies have implemented various measures such as online verification of claims and partnering with law enforcement agencies. It is important for vehicle owners to be aware of such fraudulent activities and report any suspicious behavior to the relevant authorities.

When selecting a motor insurance policy, it is important to consider various factors such as the type of vehicle, coverage requirements, and budget. Some insurance companies offer customized policies that cater to specific needs and preferences.

Select Motor insurance policy from GroMo app, where you can sell many other insurances and earn even more!

It is also recommended to compare policies and premiums offered by different insurers before making a decision.

In conclusion, motor insurance is an important aspect of vehicle ownership in India that provides financial protection and legal compliance.

With the availability of a wide range of options and the convenience of online purchase and renewal, selecting the right policy and insurer has become easier than ever before. Regular renewal of the policy, understanding the coverage details, and being aware of fraudulent activities can ensure a hassle-free experience in case of any unforeseen events.

It is also important to note that there are various types of motor insurance policies available in India. The most common types include third-party insurance, comprehensive insurance, and standalone own-damage insurance.

Third-party insurance is the minimum legal requirement in India and covers only damages caused to a third-party vehicle or property. It does not cover damages to the policyholder's own vehicle. Comprehensive insurance, on the other hand, offers a wider range of coverage that includes damages caused to both third-party and own vehicle. It also covers other risks such as theft, fire, natural calamities, and personal accident.

Standalone own-damage insurance is a relatively new type of policy that covers damages caused to the policyholder's own vehicle. It can be purchased as a standalone policy or as an add-on to an existing third-party policy. This type of policy is particularly useful for vehicle owners who do not require comprehensive coverage but want to protect their vehicle against damages caused by accidents, theft, or natural calamities.

In addition to these types of policies, insurance companies also offer various add-ons or riders that can enhance the coverage of the policy. Some common add-ons include zero depreciation, engine protection, roadside assistance, and personal accident cover.

It is important to understand the coverage details and limitations of each type of policy and add-on before making a decision. This can help prevent any surprises or unexpected costs in case of a claim.

ALSO CHECK OUT-

- Vehicle Loan- What Is Vehicle Loan?

- Insurance Meaning: What Is It And Related Terms Explained

- How To Buy The Best Health Insurance In India

- Things To Consider When Buying Motor Insurance In India

Key Takeaways

Motor insurance is mandatory in India as per the Motor Vehicles Act, 1988, and provides financial protection and legal compliance in case of accidents, theft, or damage to the vehicle.

There are two types of motor insurance policies: third-party liability insurance and comprehensive insurance. Third-party insurance is the minimum requirement by law, while comprehensive insurance offers more extensive coverage.

Motor insurance premium rates are calculated based on several factors such as the type of vehicle, age of vehicle, location, and other factors. Insurance companies offer several discounts and add-ons that can reduce the premium rates and provide additional benefits.

The claim settlement process involves filing an FIR with the local police station, informing the insurance company, and providing the necessary documents and information. In case of a third-party claim, the insurance company may provide legal assistance and representation in court.

GroMo Insure- A brand under Vitrak Insurance Brokers Private Limited