Motor Insurance Policy: Benefits of Motor Insurance

From understanding coverage options to navigating the claims process, our experts provide valuable insights and tips to help you make informed decisions

Thank you for the opportunity to write this comprehensive blog on motor insurance policies. In this blog, we will explore everything you need to know about motor insurance policies, including their types, details, renewal processes, and much more. Whether you are a first-time car owner or a seasoned driver, this blog will help you understand the intricacies of motor insurance policies in India.

Motor Insurance Policy

Motor insurance policy, also known as vehicle insurance policy, is a type of insurance policy that offers protection against financial losses incurred due to accidents or theft of your motor vehicle. It is mandatory to have a motor insurance policy in India under the Motor Vehicles Act, of 1988, which requires every vehicle owner to have at least third-party insurance coverage.

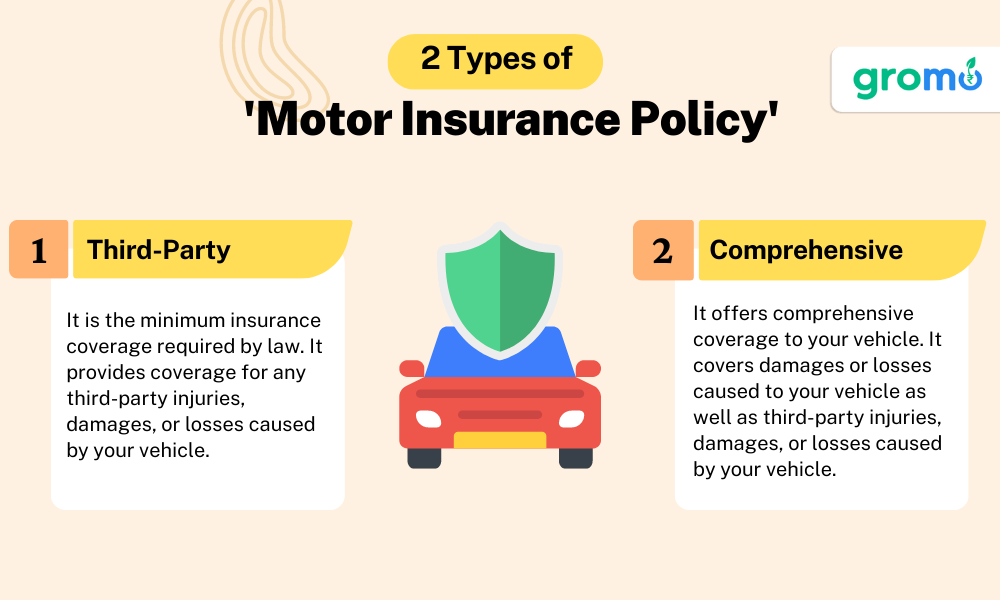

Types of Motor Insurance Policy

There are mainly two types of motor insurance policies available in India:

Third-Party Insurance Policy

Third-party insurance policy, also known as liability-only insurance policy, is the minimum insurance coverage required by law. It provides coverage for any third-party injuries, damages or losses caused by your vehicle. It does not cover any damages or losses caused to your vehicle.

Comprehensive Insurance Policy

Comprehensive insurance policy offers comprehensive coverage to your vehicle. It covers damages or losses caused to your vehicle as well as third-party injuries, damages or losses caused by your vehicle. It is an optional policy, but it is recommended to have comprehensive insurance coverage for complete protection of your vehicle.

Now you sell Motor Insurance and many other financial products to earn a substancial income.

DOWNLOAD GROMO

Motor Insurance Policy Details

A motor insurance policy covers the following:

Damage or loss to your vehicle due to accidents, natural calamities, or man-made disasters like theft, fire, explosion, etc.

Third-party liability coverage for any injuries, damages or losses caused to a third-party.

Personal accident coverage for the driver or owner of the vehicle.

Add-ons like zero depreciation, engine protection, roadside assistance, etc., can be included for additional coverage.

Tata Motors Insurance Policy

Tata Motors is one of the leading automobile manufacturers in India. Tata Motors Insurance Policy is a comprehensive motor insurance policy designed specifically for Tata vehicle owners. It offers complete protection to your Tata vehicle against any damages or losses caused by accidents, theft, or natural calamities. Tata Motors Insurance Policy also offers 24x7 roadside assistance for emergency situations.

How to Renew National Insurance Motor Policy

Renewing a National Insurance Motor Policy is a simple and hassle-free process. Here are the steps to renew your National Insurance Motor Policy:

-

Visit the official website of National Insurance Company.

-

Click on the 'Renew Policy' tab.

-

Enter your policy number and vehicle registration number.

-

Click on the 'Renew Policy' button.

-

Review your policy details and select the add-ons if required.

-

Make the payment using a debit/credit card or net banking.

-

Once the payment is successful, you will receive a confirmation message along with the renewed policy document.

GO CHECK OUT-

- Earn Commission By Selling Credit Cards Online

- Are You Aware Of The Benefits That Come Along With A High CIBIL Score?

- Things To Consider When Buying Motor Insurance In India

- Insurance Meaning: What Is It And Related Terms Explained

ICICI Lombard Motor Insurance Policy Details

ICICI Lombard is one of the leading motor insurance providers in India. ICICI Lombard Motor Insurance Policy offers comprehensive coverage to your vehicle with add-ons like zero depreciation, roadside assistance, etc. ICICI Lombard Motor Insurance Policy also provides cashless claim settlement and 24x7 customer support for a hassle-free experience.

ICICI Lombard Motor Insurance Policy Renewal Online

Renewing your ICICI Lombard Motor Insurance Policy online is a quick and easy process. Here are the steps to renew your ICICI Lombard Motor Insurance Policy online:

Visit the official website of ICICI Lombard

- Click on the 'Renew Policy' tab.

- Enter your policy number and vehicle registration number.

- Review your policy details and select the add-ons if required.

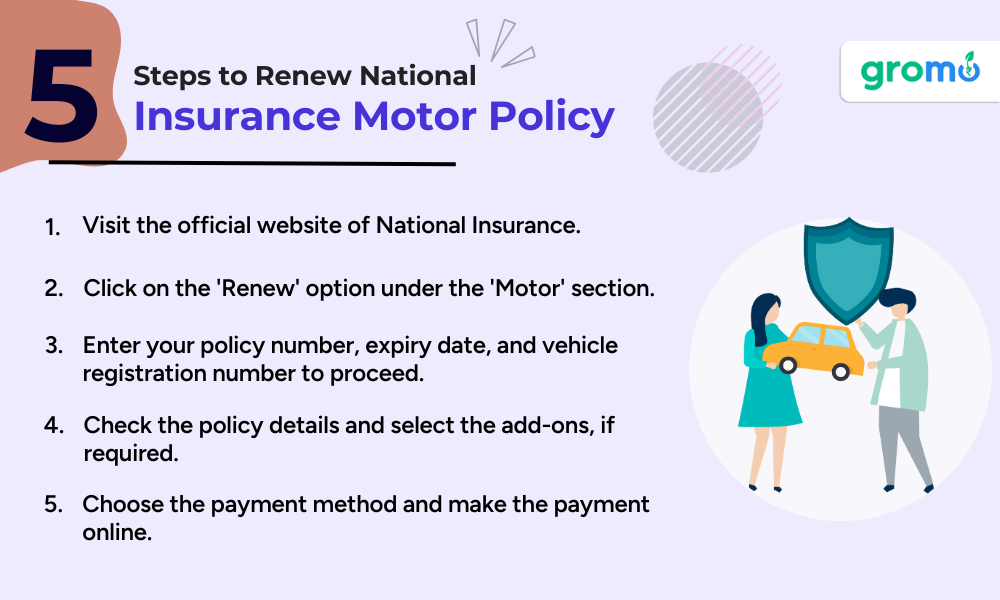

How to Renew National Insurance Motor Policy

National Insurance is a well-known insurance provider in India, and it offers various types of motor insurance policies to cater to different customer needs. If you have a National Insurance motor policy that is about to expire, you can renew it online or offline.

Here are the steps to renew your National Insurance motor policy online:

-

Visit the official website of National Insurance and click on the 'Renew' option under the 'Motor' section.

-

Enter your policy number, expiry date, and vehicle registration number to proceed.

-

Check the policy details and select the add-ons, if required.

-

Choose the payment method and make the payment online.

Once the payment is successful, you will receive the policy document via email.

To renew your National Insurance motor policy offline, you can visit the nearest National Insurance branch and follow the renewal process. You will have to fill up the renewal form and submit it along with the required documents and premium payment.

Now you can sell Insurance and many other financial products and earn smooth income using the GroMo app

ICICI Lombard Motor Insurance Policy Details

ICICI Lombard is a popular insurance provider in India, and it offers various types of motor insurance policies to cater to different customer needs. Here are some details of the ICICI Lombard motor insurance policy:

ICICI Lombard offers two types of motor insurance policies – third-party insurance and comprehensive insurance.

Third-party insurance is mandatory by law and covers damages caused to third-party property or person due to the insured vehicle.

Comprehensive insurance covers damages caused to the insured vehicle as well as third-party property or person due to the insured vehicle.

ICICI Lombard offers various add-ons with its motor insurance policies, such as zero depreciation cover, roadside assistance, engine protect cover, etc.

The premium for the ICICI Lombard motor insurance policy depends on various factors such as the age of the vehicle, the make and model of the vehicle, the geographical location, etc.

ICICI Lombard offers a cashless claim settlement process, where the insured can get their vehicle repaired at a network garage without paying any cash.

ICICI Lombard also offers a hassle-free claim settlement process, where the insured can file the claim online or through a toll-free number and track the status of the claim online.

ICICI Lombard Motor Insurance Policy Renewal Online

Renewing your ICICI Lombard motor insurance policy online is a quick and hassle-free process. Here are the steps to renew your ICICI Lombard motor insurance policy online:

-

Visit the official website of ICICI Lombard and click on the 'Renew' option under the 'Motor Insurance' section.

-

Enter your policy number and vehicle registration number to proceed.

-

Check the policy details and select the add-ons, if required.

-

Choose the payment method and make the payment online.

Once the payment is successful, you will receive the policy document via email.

You can also renew your ICICI Lombard motor insurance policy offline by visiting the nearest ICICI Lombard branch and following the renewal process. You will have to fill up the renewal form and submit it along with the required documents and premium payment.

Motor Car Insurance Policy

Motor car insurance policy is a type of insurance policy that provides coverage for damages caused to the insured car due to various reasons such as accidents, theft, natural calamities, etc. It is mandatory by law to have third-party insurance for all vehicles in India, and it is advisable to opt for comprehensive insurance to get comprehensive coverage.

Here are some key features of motor car insurance policy:

-

Motor car insurance policy offers coverage for damages caused to the insured car due to accidents, theft, fire, natural calamities, etc.

-

Motor car insurance policy offers coverage for damages caused to third-party property or person due to the insured car.

ICICI Lombard Motor Insurance Policy Renewal Online

ICICI Lombard is a leading insurance company that offers a range of insurance products to its customers. It is known for its motor insurance policies that provide comprehensive coverage to vehicle owners. In this section, we will discuss ICICI Lombard motor insurance policy details, types of motor insurance policies offered by the company, and how to renew your ICICI Lombard motor insurance policy online.

ICICI Lombard Motor Insurance Policy Details

ICICI Lombard motor insurance policy provides comprehensive coverage to vehicle owners. The policy covers damages caused to the insured vehicle due to accidents, theft, fire, natural calamities, and man-made disasters. The policy also covers third-party liabilities, including bodily injury and property damage. It provides personal accident cover to the owner/driver of the vehicle. The policy offers various add-on covers like zero depreciation cover, engine protector cover, and roadside assistance cover.

ALSO CHECK OUT-

- How To Become A GroMo Partner And Sell Insurance Policies And Earn?

- Investment Insurance: What Is Investment Insurance?

- Term Life Insurance: What Is Term Life Insurance?

- Health Insurance: What Is Health Insurance?

Types of Motor Insurance Policy

ICICI Lombard offers two types of motor insurance policies - third-party liability insurance and comprehensive insurance.

Third-Party Liability Insurance: Third-party liability insurance is mandatory in India for all vehicle owners. It covers the third-party liabilities arising out of an accident. It includes bodily injury, death, or property damage caused to a third party.

Comprehensive Insurance: Comprehensive insurance provides coverage for third-party liabilities as well as damages caused to the insured vehicle. It includes damages caused due to accidents, theft, fire, natural calamities, and man-made disasters.

ICICI Lombard Motor Insurance Policy Renewal Online

ICICI Lombard motor insurance policy can be renewed online in a few easy steps. Here's how you can renew your ICICI Lombard motor insurance policy online:

Step 1: Visit the ICICI Lombard website and click on the 'Renewal' option.

Step 2: Enter your policy number and other details like your vehicle registration number, previous policy details, and contact information.

Step 3: Select the add-ons that you want to add to your policy.

Step 4: Review the policy details and make the payment online.

Step 5: Once the payment is confirmed, your policy will be renewed, and you will receive a soft copy of the policy document via email.

motor insurance policies are essential for vehicle owners to protect themselves and their vehicles from unforeseen circumstances. It is essential to understand the different types of motor insurance policies and the coverage they provide.

ICICI Lombard is a leading insurance company that provides comprehensive motor insurance policies to its customers. By renewing your ICICI Lombard motor insurance policy online, you can ensure that your vehicle remains protected at all times.

Renewing your motor insurance policy online is a convenient and hassle-free process that can be done in just a few clicks.

Here's how to renew your motor insurance policy online with ICICI Lombard:

-

Visit the ICICI Lombard website and log in to your account using your customer ID and password.

-

Go to the 'Renew Policy' section and enter your policy details, such as policy number and expiry date.

-

Select the type of policy you want to renew, and choose any additional coverage options that you require.

-

Check and verify the details entered, and proceed to make the payment online.

-

Once the payment is complete, you will receive a confirmation message and the renewed policy will be sent to your registered email address.

Renewing your motor insurance policy online is a quick and easy process that can save you time and effort. It's important to renew your policy before it expires to avoid any penalties or fines, and to ensure that your vehicle remains protected at all times.

Motor Car Insurance Policy Renewal Online

Renewing your motor car insurance policy online is a convenient and hassle-free process that can be done in just a few clicks.

Here's how to renew your motor car insurance policy online with SBI General Insurance:

-

Visit the SBI General Insurance website and log in to your account using your customer ID and password.

-

Go to the 'Renew Policy' section and enter your policy details, such as policy number and expiry date.

-

Select the type of policy you want to renew, and choose any additional coverage options that you require.

Check and verify the details entered, and proceed to make the payment online.

Once the payment is complete, you will receive a confirmation message and the renewed policy will be sent to your registered email address.

Renewing your motor car insurance policy online is a quick and easy process that can save you time and effort. It's important to renew your policy before it expires to avoid any penalties or fines, and to ensure that your vehicle remains protected at all times.

Motor insurance policies are an essential tool for any vehicle owner looking to protect their vehicle against damage or theft. There are various types of motor insurance policies available in India, each with its own unique features and benefits.

It's important to choose the right motor insurance policy that suits your specific requirements and offers adequate coverage for your vehicle. Factors such as the type of vehicle, its age, and your driving history can all impact the type of policy that is best for you.

When renewing your motor insurance policy, be sure to do so well in advance of the expiry date to avoid any penalties or fines. You can renew your policy online with most insurance providers, which is a quick and easy process that can be done in just a few clicks.

Ultimately, investing in a good motor insurance policy can provide peace of mind and protection for your vehicle, giving you the confidence to hit the road without any worries.

Renewing Your Motor Insurance Policy Online

Renewing your motor insurance policy is a straightforward process that can now be completed online with ease.

Here's how to renew your motor insurance policy online:

-

Visit the website of your motor insurance provider: Start by visiting the website of your motor insurance provider. Most motor insurance companies in India offer online renewal of motor insurance policies through their website.

-

Enter your policy details: Once you're on the website, enter your policy details such as policy number, date of expiry, and vehicle registration number.

-

Check the policy details: After entering your policy details, the website will display your policy details for verification. Check the details to make sure they are accurate.

-

Make the payment: After verifying your policy details, you can proceed to make the payment using any of the available payment options such as debit card, credit card, net banking, or e-wallets.

-

Receive the policy document: Once the payment is processed, you will receive a soft copy of the policy document via email. You can also download and print the policy document for your records.

It is important to renew your motor insurance policy on time to ensure that your vehicle is always insured. If you miss the renewal date, you may be subject to penalties and your vehicle may not be insured until you renew the policy.

Motor insurance is a critical component of responsible vehicle ownership in India. It offers financial protection against unexpected events such as accidents, theft, and damage to your vehicle. There are several types of motor insurance policies available in India, each with its own set of benefits and features.

When choosing a motor insurance policy, it is important to consider your individual requirements and budget. Make sure to read the policy documents carefully and understand the terms and conditions before making a decision.

Finally, don't forget to renew your motor insurance policy on time to ensure that your vehicle is always protected. With online renewal options, renewing your policy has never been easier.

Factors that affect your motor insurance policy renewal online

Renewing your motor insurance policy online has never been easier. You can do it at the comfort of your home or office. However, there are certain factors that you should keep in mind before renewing your motor insurance policy online.

Let's take a look at some of these factors:

-

Age of the Vehicle: The age of your vehicle plays a crucial role in determining the premium for your motor insurance policy. A new car will have a higher premium than an older one. The older your car, the lower your premium will be.

-

Claim History: Your claim history is another factor that will affect your motor insurance policy renewal online. If you have made any claims in the past, your premium is likely to be higher. On the other hand, if you have not made any claims, your premium is likely to be lower.

-

Type of Coverage: The type of coverage you choose will also affect your premium. If you opt for a comprehensive coverage, your premium will be higher. If you opt for a third-party coverage, your premium will be lower.

-

No-Claim Bonus: No-Claim Bonus (NCB) is a discount offered by insurance companies to policyholders who have not made any claims during the policy period. If you have an NCB, your premium will be lower.

-

Add-Ons: Insurance companies offer various add-ons to enhance your coverage. These add-ons come at an additional cost and will affect your premium.

-

Deductibles: Deductibles are the amount that you agree to pay out of your pocket before the insurance company pays the rest. If you opt for a higher deductible, your premium will be lower.

-

Insured Declared Value: Insured Declared Value (IDV) is the maximum amount that the insurance company will pay in case of total loss or theft of your vehicle. The higher the IDV, the higher the premium.

-

Make and Model of the Vehicle: The make and model of your vehicle also affect the premium. High-end cars have a higher premium than economy cars.

-

Location: Your location also affects the premium. If you live in an area with high crime rates or accidents, your premium will be higher.

-

Renewal Timeline: Renewing your motor insurance policy before it expires is always advisable. Insurance companies offer discounts for early renewals. If you renew your policy after it has expired, you will have to pay a higher premium.

These are some of the factors that you should keep in mind before renewing your motor insurance policy online. By taking these factors into consideration, you can save money on your premium and get the best coverage for your vehicle.

KEY TAKEAWAYS

-

Third-party motor insurance is mandatory in India and covers the damages caused by the policyholder's vehicle to third-party property or person.

-

Comprehensive motor insurance policies cover not only third-party damages but also damages to the policyholder's vehicle and provide additional features such as personal accident cover, roadside assistance, and no-claim bonus.

-

The premium for motor insurance policies depends on factors such as the type and age of the vehicle, the location of the policyholder, and the add-ons opted for.

-

It is crucial to compare the features, coverage, and premium offered by different insurance providers before purchasing a motor insurance policy.

-

Making timely premium payments, avoiding making small claims, and maintaining a good driving record can help policyholders avail discounts and lower their insurance premium.