LIC Policy: Best LIC Policies In 2024

Want to protect your family's financial future? LIC policies can help you. Discover the Best LIC policy for 2024 in our comprehensive guide.

Unforeseen events can unfold at any point of time in life. Preparing for any unforeseen event in advance is essential in today’s time. Having a LIC policy is the most important of them all. However, buying a life insurance policy can be challenging at times.

Understanding the terms, conditions, and eligibility requirements of an insurance policy is crucial to maximize its benefits. Additionally, comparing the top insurance plans in the market is essential. Comparing policies can help to determine the most suitable insurance policy that you should buy.

Buying a life insurance policy will provide you with the required coverage and thus can help you live a stress-free life. LIC policy is the most popular name in the market when it comes to life insurance and offers numerous life insurance policies.

You have the flexibility to select the plan that aligns with your preferences, making it the insurance policy that best suits you. The offered LIC policy is according to the affordability of working professionals. Moreover, you can download the GroMo mobile app to compare different life insurance policies and buy the most suitable life insurance policy.

In this blog post, we'll explore the following subjects:

- What is LIC?

- What is Insurance?

- Detailed Explanation of the Best LIC Policy

- LIC Jeevan Umang Policy

- LIC Jeevan Anand Policy

- LIC Jeevan Shanti Plan

- LIC Kanyadan Policy

...and much more. Here, you'll discover in-depth explanations of the finest LIC policies and guidance on making the right choice.

Let’s get started!

What is LIC?

Life Insurance Corporation of India (LIC) is the largest insurance company in India. It was founded in 1956 and is owned by the Government of India. LIC offers a wide range of insurance products, including life insurance, health insurance, and pension plans.

LIC is a reliable company with a long history. It has a strong financial position and is well-regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

Also Check Out: Benefits Of Term Life Insurance: About Term Life Insurance

What is Insurance?

Insurance is a financial product that protects you from financial losses. When you buy an insurance policy, you are essentially paying a premium to the insurance company. In return, the insurance company agrees to pay you a certain amount of money if you suffer a loss that is covered by the policy.

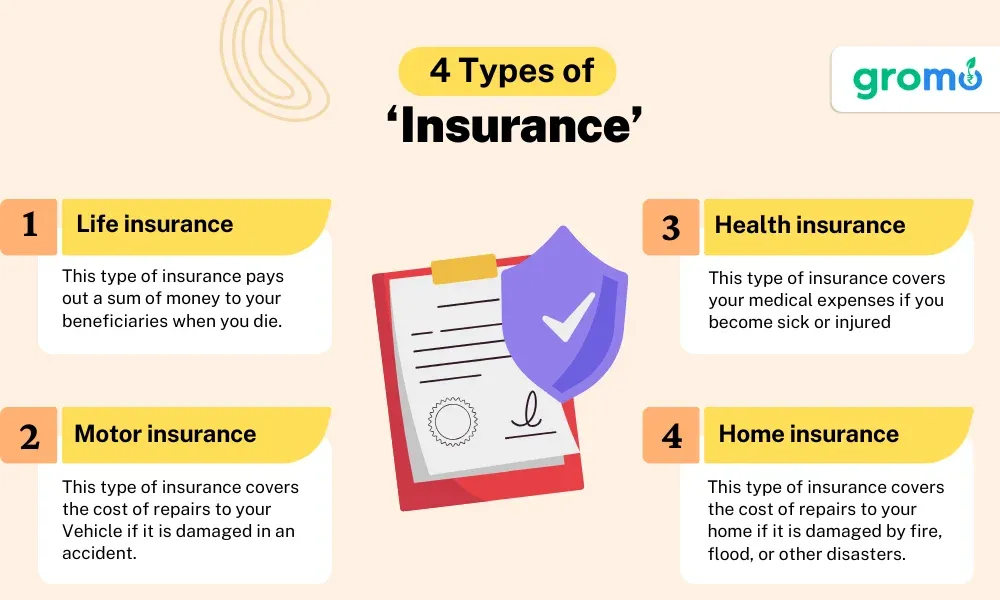

There are many different types of insurance, but some of the most common types include:

-

Life insurance: This type of insurance pays out a sum of money to your beneficiaries when you die.

-

Health insurance: This type of insurance covers your medical expenses if you become sick or injured.

-

Motor insurance: This type of insurance covers the cost of repairs to your Vehicle if it is damaged in an accident.

-

Home insurance: This type of insurance covers the cost of repairs to your home if it is damaged by fire, flood, or other disasters.

LIC offers all the above-mentioned insurance options, excluding motor insurance.

Detailed Explanation of the Best LIC Policy

1. LIC Jeevan Umang Policy

LIC Jeevan Umang policy is one of the best plans from LIC. It provides lifelong insurance coverage and gives both income and protection to your family. LIC Jeevan Umang policy offers yearly bonuses to you once you've finished paying your premiums until your policy matures.

When your policy matures or if something happens to you during the policy term, your nominee will receive a lump sum of money. Let's explore what LIC Jeevan Umang has to offer in terms of its features and benefits.

Features of LIC Jeevan Umang Policy

- It is a non-linked, with-profits, whole life insurance policy.

- The policyholder can choose to pay a premium for a fixed number of years or for the entire tenure of the LIC policy.

- LIC Jeevan Umang policy also provides a maturity benefit, which is payable to the policyholder on survival to the end of the LIC policy term.

- LIC Jeevan Umang policy also provides a number of riders, such as accidental death benefit rider, disability benefit rider, and waiver of premium rider.

Benefits of LIC Jeevan Umang Policy

1. Guaranteed death benefit: The policyholder's family is guaranteed to receive the death benefit, even if the policyholder dies prematurely.

2. Maturity benefit: The policyholder receives the maturity benefit if they survive to the end of the LIC policy term.

3. Tax benefits: The premiums paid for LIC Jeevan Umang Policy are eligible for tax deductions under Section 80C of the Income Tax Act, 1961.

4. Flexibility in terms of premium payment: The policyholder can choose to pay the premiums monthly, quarterly, half-yearly, or annually.

If you are looking for a life insurance policy that offers financial security for your family, the LIC Jeevan Umang policy is a good option to consider.

2. LIC Jeevan Anand Policy

LIC Jeevan Anand policy does two important things. First, if the person with the insurance passes away, it gives money to their family to help them financially. Second, if the person stays alive throughout the policy's time, they get some money when it's done. Plus, LIC Jeevan Anand policy lets you borrow money if you need it in an emergency.

Features of LIC Jeevan Anand Policy

- It is a non-linked, participating, whole life insurance policy.

- The policyholder can choose to pay premiums for a fixed number of years or the entire tenure of the policy.

- The maturity benefit is calculated based on the sum assured and the policy term.

- The LIC Jeevan Anand policy also provides several riders, such as accidental death benefit rider, disability benefit rider, and waiver of premium rider.

Benefits of LIC Jeevan Anand Policy

1. Guaranteed death benefit: The policyholder's family is guaranteed to receive the death benefit, even if the policyholder dies prematurely.

2. Maturity benefit: The policyholder receives the maturity benefit if they survive to the end of the policy term.

3. Tax benefits: The premiums paid for LIC Jeevan Anand policy are eligible for tax deductions under Section 80C of the Income Tax Act, 1961.

4. Flexibility in terms of premium payment: The policyholder can choose to pay the premiums monthly, quarterly, half-yearly, or annually.

5. Loyalty Additions: The policyholder is eligible to receive loyalty additions on the sum assured at the end of each policy year if the premiums are paid regularly

6. Paid-up Value: The policyholder has the option to surrender the LIC policy at any time after the policy has been in force for at least three years. The policyholder will receive the paid-up value, which is the surrender value of the policy.

7. Loan facility: The policyholder can avail of a loan against the LIC policy after the policy has been in force for at least three years. The loan amount will be based on the surrender value of the policy.

If you are looking for a life insurance policy that offers financial security for your family and has several benefits, the LIC Jeevan Anand policy is a good option to consider.

3. LIC Jeevan Shanti Plan

LIC Jeevan Shanti Plan is a plan where you pay a big lump sum of money upfront to get insurance later. You can also decide if you want this plan for yourself or with someone else, like a partner, and choose when you want the insurance to start.

Features of LIC Jeevan Shanti plan

- It is a non-linked, non-participating, single-premium, whole-life insurance plan.

- The policyholder can choose the policy term depending on their needs.

- The death benefit is calculated based on the sum assured and the policy term.

- LIC Jeevan Shanti plan does not provide any maturity benefit.

Benefits of LIC Jeevan Shanti plan

1. Guaranteed death benefit: The policyholder's family is guaranteed to receive the death benefit, even if the policyholder dies prematurely.

2. Flexibility in terms of policy term: The policyholder can choose the policy term depending on their needs. This can be helpful if the policyholder wants to provide financial security for their family for a specific period of time.

3. No need to pay premiums after the policy is issued: Once the LIC Jeevan Shanti plan is issued, the policyholder does not need to pay any more premiums. This can be helpful if the policyholder is concerned about their ability to pay premiums in the future.

If you are looking for a life insurance policy that provides financial security for your family and does not require you to pay premiums after the policy is issued, the LIC Jeevan Shanti plan is a good option to consider.

4. LIC Kanyadan Policy

LIC Kanyadan Policy is a non-linked, non-participating, endowment plan that helps parents save money for their daughter's marriage. The LIC Kanyadan Policy provides a lump sum amount on maturity, which can be used for the daughter's marriage. The LIC Kanyadan Policy also provides a death benefit, which is payable to the nominee on the death of the policyholder.

Features of LIC Kanyadan Policy

- It is a non-linked, non-participating, endowment plan.

- The LIC Kanyadan Policy is designed to help parents save money for their daughter's marriage.

- The policyholder can choose to pay premiums for a fixed number of years or the entire tenure of the LIC policy.

- LIC Kanyadan Policy provides a lump sum amount on maturity, which can be used for the daughter's marriage.

Benefits of LIC Kanyadan Policy

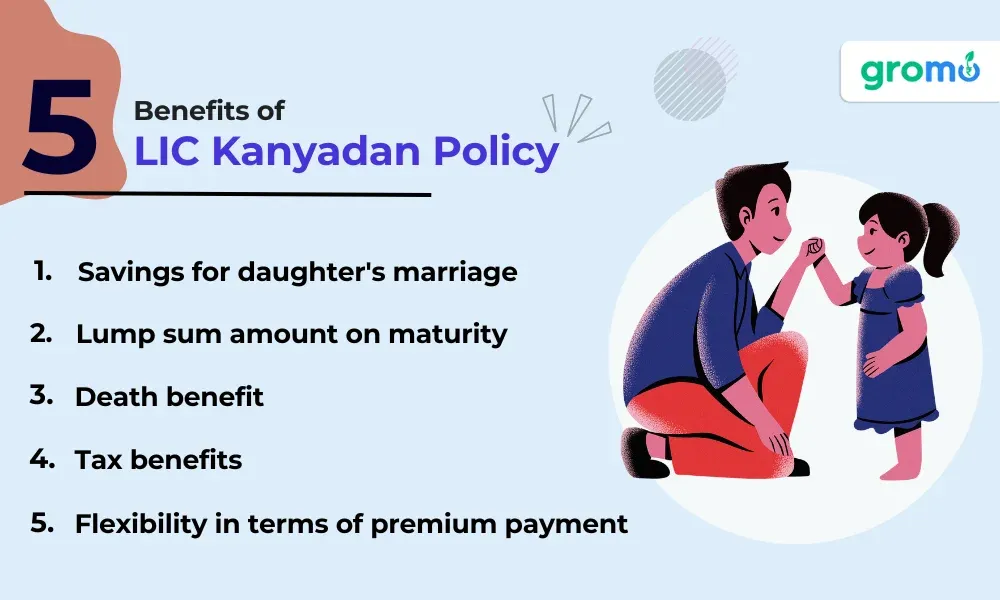

1. Savings for daughter's marriage: The LIC policy helps parents save money for their daughter's marriage.

2. Lump sum amount on maturity: The LIC Kanyadan Policy provides a lump sum amount on maturity, which can be used for the daughter's marriage.

3. Death benefit: The policy provides a death benefit, which is payable to the nominee on the death of the policyholder.

4. Tax benefits: The premiums paid for LIC Kanyadan Policy are eligible for tax deductions under Section 80C of the Income Tax Act, 1961.

5. Flexibility in terms of premium payment: The policyholder can choose to pay the premiums monthly, quarterly, half-yearly, or annually.

Key Takeaways

- LIC (Life Insurance Corporation of India) holds the title of being India's biggest insurance company.

- LIC Jeevan Umang Policy offers lifelong coverage with income and family protection.

- LIC Jeevan Anand Policy provides financial support to the insured person's family if they pass away, and it gives some money to the insured person if they complete the policy term.

- LIC Jeevan Shanti Policy is a plan where you make a single large payment upfront for future insurance.

- LIC Kanyadan Policy is an endowment plan for parents to save for their daughter's wedding.