Investment Products: What Are Investment Products?

Explore a range of investment products like stocks, bonds, and mutual funds. Get expert advice on the best investments for your portfolio.

Investment banking products are financial instruments that allow individuals and businesses to grow their wealth by investing in various assets. These products can range from stocks and bonds to real estate and mutual funds. In this article, we will provide a comprehensive guide to investment products and their services, including investment banking products, tube investment products, investment casting products, and more.

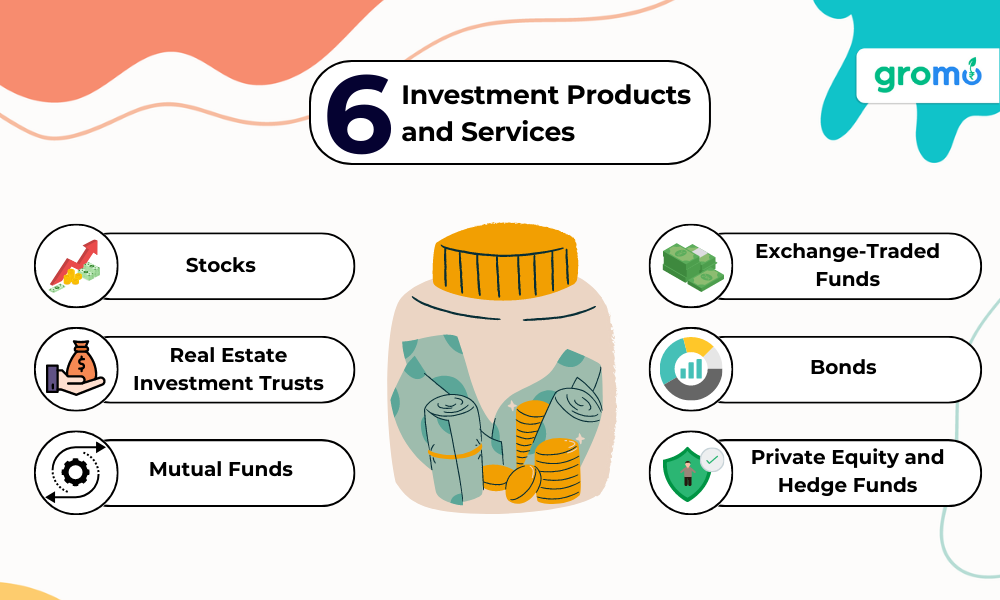

Investment Products and Services

Investment banking products and services are designed to help individuals and businesses achieve their financial goals. These products can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and alternative investments like private equity and hedge funds.

-

Stocks

Stocks are a type of investment product that represents ownership in a company. When you purchase a stock, you are buying a share of ownership in that company. Stocks can be traded on exchanges, and their value can fluctuate based on market conditions and the performance of the company. -

Bonds

Bonds are debt securities that are issued by corporations or governments. When you purchase a bond, you are essentially lending money to the issuer in exchange for interest payments. Bonds can provide a steady stream of income and are generally considered less risky than stocks. -

Mutual Funds

Mutual funds are investment banking products that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. Mutual funds are managed by professional fund managers and can provide investors with a convenient way to diversify their investments. -

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they are a type of investment product that tracks a basket of stocks, bonds, or other securities. However, ETFs trade on exchanges like stocks and can be bought and sold throughout the trading day. -

Real Estate Investment Trusts (REITs)

REITs are a type of investment product that invests in real estate properties and mortgages. REITs allow investors to own a share of a portfolio of real estate assets, and can provide a steady stream of income in the form of rental payments and dividends. -

Private Equity and Hedge Funds

Private equity and hedge funds are alternative investment products that are generally only available to accredited investors. These products can invest in a wide range of assets, including private companies, real estate, and commodities. -

Investment Banking Products

Investment banking products are financial instruments that are designed to help companies raise capital and manage risk. Investment banks provide a wide range of services to corporate clients, including underwriting and issuing securities, mergers and acquisitions advisory, and debt and equity financing.

-

Underwriting and Issuing Securities

Investment banks can underwrite and issue securities on behalf of companies. This can include initial public offerings (IPOs) of stocks and bonds, as well as secondary offerings of existing securities. -

Mergers and Acquisitions Advisory

Investment banks can also provide advisory services to companies that are considering mergers or acquisitions. This can include providing strategic advice, conducting due diligence, and negotiating deal terms. -

Debt and Equity Financing

Investment banks can help companies raise capital through debt and equity financing. This can include arranging loans, issuing bonds, and helping companies raise equity capital through private placements or public offerings. -

Tube Investment Products

Tube investment products are a type of investment product that invests in steel tubes and pipes. These products can include steel tube and pipe manufacturers, as well as companies that provide related services like drilling and exploration.

Choosing the Right Investment Products

When choosing investment products, it is important to consider your investment goals, risk tolerance, and time horizon. Some investment banking products are better suited for long-term growth, while others may provide more immediate income.

Consider Your Investment Goals

Before investing in any product, it is important to consider your investment goals. Are you looking for long-term growth, or immediate income? Are you willing to take on more risk for potentially higher returns, or are you more comfortable with lower-risk investments?

Consider Your Risk Tolerance

Different investment products come with different levels of risk. Stocks, for example, can be more volatile than bonds or real estate. It is important to consider your risk tolerance when choosing investment products.

Consider Your Time Horizon

Your time horizon is the amount of time you have to invest before you need to access your funds. If you have a longer time horizon, you may be able to take on more risk for potentially higher returns. If you have a shorter time horizon, you may want to focus on investments that provide more immediate income.

Go check out-

- Need Guidance In Buying Health Insurance

- Best Selling Credit Cards in India

- How Can Financial Advisors Help You To Get The Best Health Insurance?

- How To Become A GroMo Partner And Sell Insurance Policies And Earn?

So far we understood,

Investment products are an important tool for individuals and businesses looking to grow their wealth. From stocks and bonds to real estate and alternative investments, there are a wide range of products available to suit every investment goal and risk tolerance. When choosing investment products, it is important to consider your investment goals, risk tolerance, and time horizon to ensure that you are investing in products that are right for you.

More about Investment product

Real estate investments can include direct ownership of properties, as well as investments in real estate investment trusts (REITs), which pool money from multiple investors to invest in real estate projects. Commodities, such as gold or oil, can also be used as an investment product, although they can be volatile and carry high risk.

Private equity investments involve investing in private companies that are not publicly traded. These investments can offer high potential returns, but also carry high risk and are typically only available to accredited investors.

While alternative investments can offer potentially higher returns, they also tend to be less liquid and carry higher risk. As with any investment product, it's important to thoroughly research and understand the risks before investing.

Investment banking products come in many different forms and offer a range of options for investors looking to diversify their portfolios and achieve their financial goals. By understanding your investment goals, risk tolerance, and time horizon, you can choose investment products that are right for you and work with a financial advisor to develop a diversified investment strategy that meets your needs.

Remember to always do your research and seek professional advice before making any investment decisions.

Go check out!!

- Earn Money Online By Selling Insurance Online

- 7 of the Best Money-Making Apps of 2022

- The Digital Lending Revolution & Benefits of Human Touch In Digital Banking

- 10 Reasons Why Buying Health Insurance In Your 20s Is A Good Idea

When considering investment products and services, it's also important to understand the fees and expenses associated with them. These can include management fees, transaction fees, and other expenses, which can eat into your potential returns.

Some investment products, such as index funds and ETFs, tend to have lower fees compared to actively managed mutual funds. It's important to compare fees and expenses across different investment products to make informed decisions about where to allocate your investments.

In addition to fees, taxes can also impact your investment returns. Understanding the tax implications of different investment products can help you make more informed decisions about where to allocate your investments.

One way to minimize taxes on your investments is to invest in tax-advantaged accounts, such as 401(k)s, IRAs, and 529 plans. These accounts offer tax benefits such as tax-deferred growth, tax-free withdrawals, and tax deductions on contributions, depending on the type of account.

The GroMo app helps you get access to alot more investment products, to sell and earn more.

It is important

to keep in mind that investment products and services are just one part of a comprehensive financial plan. Other components may include budgeting, insurance, estate planning, and more.

Working with a financial advisor can help you develop a comprehensive financial plan that is tailored to your unique needs and goals.

Investment products and services offer a range of options for investors looking to diversify their portfolios and achieve their financial goals.

However, it's important to understand the risks, fees, and tax implications associated with different investment products and work with a financial advisor to develop a comprehensive financial plan that meets your needs.

It's also important to keep in mind that investment products and services can be subject to market volatility and fluctuations. It's important to be patient and maintain a long-term perspective when investing, rather than making rash decisions based on short-term market movements.

Diversification is also a key component of a successful investment strategy. By investing in a range of different asset classes and sectors, you can help minimize risk and potentially achieve higher returns over the long-term. It's important to regularly review your portfolio and rebalance your investments as necessary to ensure that your portfolio remains diversified and aligned with your investment goals and risk tolerance.

Ultimately, the key to successful investing is to understand your investment goals, risk tolerance, and time horizon, and to develop a diversified investment strategy that is tailored to your unique needs. By regularly reviewing your portfolio and working with a financial advisor, you can help ensure that your investments are aligned with your goals and positioned for long-term success.

Finally, it's important to remain disciplined and stay the course when it comes to your investment strategy. This means avoiding making rash decisions based on emotions or short-term market movements, and instead sticking to your long-term investment plan.

One common mistake that investors make is trying to time the market, or buying and selling investments based on short-term market movements. This is often a losing strategy, as it's nearly impossible to predict the future movements of the market with any degree of accuracy. Instead, it's important to remain disciplined and patient, and to focus on long-term investment goals and strategies.

Another important aspect of successful investing is education. By staying informed about market trends, investment products, and the overall economy, you can make more informed investment decisions and position yourself for long-term success. There are a range of resources available to help you stay informed about investments, including financial news outlets, investment research tools, and professional financial advisors.

Key Takeaways

-

Diversification is key: One of the most important factors to consider when investing is diversification. Investing in a variety of asset classes such as stocks, bonds, real estate, and commodities can help to reduce risk and provide a more stable return on investment.

-

Start early: Time is a crucial factor in investing. Starting early allows for more time for investments to grow and compound over time. It also helps to mitigate the effects of market volatility and provides a longer time horizon for reaching investment goals.

-

Have a long-term investment horizon: Investing is a long-term game. Short-term market fluctuations can cause panic, leading to hasty investment decisions that can negatively impact returns. Having a long-term investment horizon and staying committed to a well-thought-out investment plan can help to mitigate the effects of short-term market volatility.

-

Regularly review and rebalance your portfolio: Market fluctuations can cause a shift in the allocation of assets in a portfolio. Regularly reviewing and rebalancing your portfolio can help to maintain the desired asset allocation and ensure that your investment plan is aligned with your goals.

-

Consider seeking professional advice: Investing can be complex and overwhelming, especially for those just starting out. Seeking professional advice from a financial advisor can help to ensure that your investment plan is aligned with your goals, risk tolerance, and investment horizon. A financial advisor can also provide guidance on the best investment options and strategies for achieving your investment objectives.