Investment Insurance: What Is Investment Insurance?

Discover how investment insurance can provide financial protection and growth potential for individuals

Investment and insurance are two concepts that are often used interchangeably, but they are not the same thing. Insurance is a way of protecting yourself or your loved ones from financial loss due to an unexpected event, while investment is a way of growing your wealth over time. In this article, we will explore the differences between insurance and investment, and the benefits of investing in life insurance policies.

Difference between Insurance and Investment**

Definition

Insurance is a contract between an individual and an insurance company, where the individual pays a premium in exchange for protection against a specific risk. The insurance company assumes the risk and promises to pay a certain amount of money if the insured event occurs. For example, life insurance protects your loved ones financially in case of your untimely death.

Investment, on the other hand, is the process of putting money into an asset with the expectation of receiving a profit or income in the future. For example, you can invest in stocks, bonds, or mutual funds to earn a return on your investment.

Purpose

The purpose of insurance is to protect against financial loss due to unexpected events, such as death, disability, or illness. Insurance provides financial security to the insured and their family in case of an unexpected event.

The purpose of investment is to grow your wealth over time. Investments are made with the expectation of generating a return on your investment.

Risk

Insurance is all about managing risk. The insurance company takes on the risk of the insured event occurring and charges a premium to provide protection against that risk. The amount of the premium is based on the risk of the insured event occurring and the potential financial loss.

Investment, on the other hand, involves taking on risk. Investments are not guaranteed and the return on investment can vary depending on market conditions.

Install Gromo and sell many more financial products and earn a huge amount!!

DOWNLOAD NOW

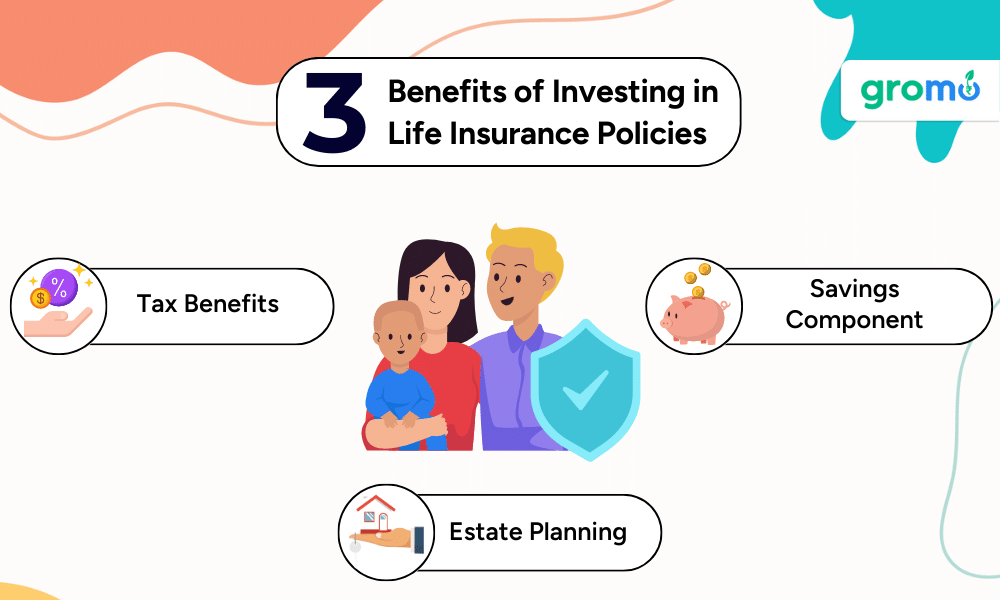

Benefits of Investing in Life Insurance Policies

Investing in life insurance policies can provide a range of benefits, including:

Financial Protection

Life insurance policies provide financial protection to your loved ones in case of your untimely death. The death benefit can help your family pay for expenses such as funeral costs, outstanding debts, and living expenses.

Tax Benefits

Life insurance policies offer tax benefits, such as tax-free death benefits and tax-deferred cash value growth. The death benefit is generally not subject to federal income tax and the cash value grows tax-deferred.

Savings Component

Life insurance policies have a savings component that can help you build cash value over time. The cash value can be borrowed against or used to pay premiums.

Estate Planning

Life insurance policies can be used as part of your estate planning strategy. The death benefit can help your heirs pay estate taxes or other expenses related to settling your estate.

So far we understand, insurance and investment are two different concepts with different purposes. Insurance is a way of protecting yourself or your loved ones from financial loss due to an unexpected event, while investment is a way of growing your wealth over time. Investing in life insurance policies can provide a range of benefits, including financial protection, tax benefits, a savings component, and estate planning.

Also Check out!!

- Term Life Insurance: What Is Term Life Insurance?

- Investment Products: A Comprehensive Guide

- Buy Now Pay Later: What Is BNPL?

- Sell Insurance Policies & Earn Commission Online Without Any Investment

It's important to understand the difference between insurance and investment to make informed financial decisions.

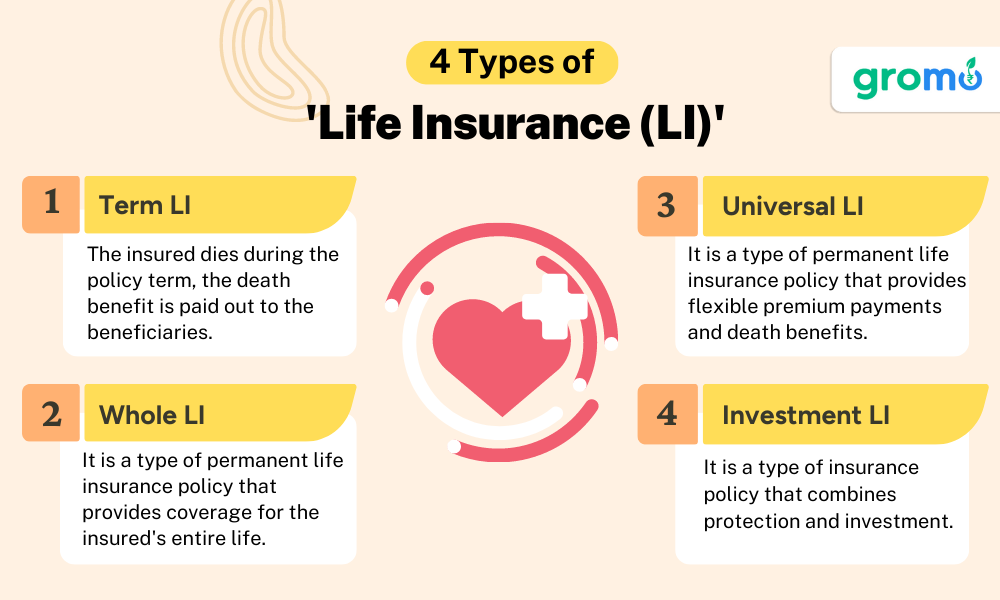

Individual Investment in Insurance Policy

Investing in an insurance policy can be a wise decision for individuals looking to protect themselves or their loved ones from financial loss in the event of an unexpected event. There are various types of insurance policies available, such as term life insurance, whole life insurance, and universal life insurance. The choice of policy depends on individual needs and financial goals.

Term Life Insurance

Term life insurance is a type of insurance policy that provides coverage for a specific period, such as 10, 20, or 30 years. If the insured dies during the policy term, the death benefit is paid out to the beneficiaries. Term life insurance is generally less expensive than permanent life insurance policies.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance policy that provides coverage for the insured's entire life. Whole life insurance policies have a savings component, known as cash value, which grows over time. The cash value can be borrowed against or used to pay premiums.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance policy that provides flexible premium payments and death benefits. Universal life insurance policies also have a savings component, known as cash value, which grows over time.

Investment Linked Insurance

Investment-linked insurance is a type of insurance policy that combines protection and investment. The premiums paid are split between the insurance coverage and the investment component. The investment component is invested in a variety of assets, such as stocks, bonds, or mutual funds.

The investment-linked insurance policy's value is based on the performance of the underlying assets. If the investments perform well, the policy's value will increase, and the policyholder can benefit from the investment returns. However, if the investments perform poorly, the policy's value may decrease.

Now you can sell too! by becoming a gromo partner.

DOWNLOAD GROMO

How Do Insurance Companies Invest?

Insurance companies invest in a variety of assets, such as stocks, bonds, real estate, and alternative investments. The investment portfolio's composition depends on the insurance company's investment strategy and risk tolerance.

Insurance companies invest their premiums in assets that can generate a return on investment, which can be used to pay claims and expenses. The investment portfolio's performance can have a significant impact on an insurance company's financial stability and ability to pay claims.

Insurance Investment Management

Insurance investment management involves managing an insurance company's investment portfolio to achieve the company's financial goals. The investment management team is responsible for selecting and managing the assets in the portfolio.

Insurance investment management focuses on maximizing investment returns while managing risk. The investment management team must balance the investment portfolio's risk and return to achieve the company's financial goals.

Is Insurance an Investment?

Insurance is not an investment in the traditional sense because insurance policies are not intended to generate a return on investment. Insurance policies provide financial protection in the event of an unexpected event, such as death, disability, or illness.

However, some insurance policies have a savings component, such as whole life insurance or universal life insurance. The savings component can be considered an investment because it can grow over time and provide a cash value that can be borrowed against or used to pay premiums.

Perception of Investors Investing in Life Insurance

A study on the perception of investors investing in life insurance found that investors generally perceive life insurance as a safe investment with low risk. Life insurance is viewed as a stable investment option that provides financial protection and tax benefits.

Investors also perceive life insurance as a long-term investment that can provide financial security for themselves and their families. The study found that investors were willing to invest in life insurance policies if they believed that the policies met their financial goals and provided adequate financial protection.

Insurance and Investment Companies

Insurance and investment companies offer a range of products and services to help individuals and businesses manage their financial needs. The best insurance and investment company in the Philippines depends on individual needs

and preferences. Some popular insurance and investment companies in the Philippines include Pru Life UK, Manulife Philippines, and Sun Life Financial Philippines.

These companies offer a range of insurance and investment products, such as life insurance, health insurance, retirement plans, and investment funds. Individuals can choose from various options depending on their financial goals, risk tolerance, and investment horizon.

Insurance Investment Plan

An insurance investment plan is a type of investment product that combines insurance coverage and investment. These plans provide financial protection and investment returns, making them a popular choice for individuals looking to achieve multiple financial goals.

Insurance investment plans typically have a savings component that can be invested in various assets, such as stocks, bonds, or mutual funds. The investment returns are used to increase the policy's cash value, which can be borrowed against or used to pay premiums.

Investment Insurance

Investment insurance is a type of insurance policy that provides financial protection and investment returns. These policies have a savings component, known as cash value, which can be invested in a variety of assets, such as stocks, bonds, or mutual funds.

The policy's value is based on the performance of the underlying assets. If the investments perform well, the policy's value will increase, and the policyholder can benefit from the investment returns. However, if the investments perform poorly, the policy's value may decrease.

- Connecticut General Life Insurance Company Inc Investment Arm

The Connecticut General Life Insurance Company, also known as Cigna, has an investment arm known as Cigna Investments. Cigna Investments manages the company's investment portfolio and provides investment solutions to other institutional clients.

Cigna Investments manages a range of assets, such as fixed income securities, equity securities, and alternative investments. The investment portfolio is managed by a team of experienced investment professionals who aim to maximize returns while managing risk.

- American Equity Investment Life Insurance Company of New York

The American Equity Investment Life Insurance Company of New York is a subsidiary of American Equity Investment Life Holding Company. The company provides a range of annuity and life insurance products to individuals and businesses.

American Equity Investment Life Insurance Company of New York's products include fixed index annuities, multi-year guaranteed annuities, and life insurance policies. These products are designed to help individuals and businesses manage their financial needs and achieve their financial goals.

- Wise Owl Investments & Insurance Marketing LLP

Wise Owl Investments & Insurance Marketing LLP is an insurance and investment marketing company based in India. The company offers a range of products and services to help individuals and businesses manage their financial needs.

Wise Owl Investments & Insurance Marketing LLP's products include life insurance, health insurance, motor insurance, travel insurance, and investment solutions. The company works with leading insurance and investment providers to offer a range of options to its clients.

Also check out!

- Motor Insurance: What Is Motor Insurance?

- Health Insurance: What Is Health Insurance?

- Term Life Insurance: What Is Term Life Insurance?

- Investment Products: A Comprehensive Guide

Insurance and investment are two important components of financial planning. Insurance provides financial protection in the event of an unexpected event, while investment provides the opportunity to grow wealth over time.

Investment-linked insurance policies and insurance investment plans are popular options for individuals looking to combine insurance coverage and investment returns. Insurance companies invest their premiums in a range of assets, and insurance investment management focuses on maximizing investment returns while managing risk.

Perceptions of investors investing in life insurance are generally positive, with life insurance viewed as a safe investment with low risk. Insurance and investment companies offer a range of products and services to help individuals and businesses manage their financial needs, and the best insurance and investment company in the Philippines depends on individual needs and preferences.

Connecticut General Life Insurance Company, Inc. has an investment arm known as Cigna Investments, which manages a range of assets and provides investment solutions to institutional clients. The American Equity Investment Life Insurance Company of New York is a subsidiary of American Equity Investment Life Holding Company and provides a range of annuity and life insurance products. Wise Owl Investments & Insurance Marketing LLP is an insurance and investment marketing company based in India that offers a range of products and services.

In the end, the choice of insurance and investment products depends on individual financial goals, risk tolerance, and investment horizon. Some individuals may prioritize the safety of their investment, while others may be willing to take on more risk to achieve higher returns. It is important to carefully consider all options and consult with a financial advisor before making any investment decisions.

Insurance and investment are important components of financial planning, and combining them can provide financial protection and growth potential. Investment-linked insurance policies and insurance investment plans are popular options for individuals looking to achieve multiple financial goals. Insurance companies invest their premiums in a range of assets, and insurance investment management focuses on maximizing investment returns while managing risk. There are various insurance and investment companies in the market, and the best option depends on individual needs and preferences. It is important to carefully consider all options and consult with a financial advisor before making any investment decisions.

Investors should also be aware of the difference between insurance and investment, as they are two separate financial products. Insurance is meant to provide financial protection against unforeseen events, such as illness, disability, or death, while investment is meant to provide growth and returns on capital. Some insurance products, such as investment-linked insurance policies, combine both insurance and investment components, but it is important to understand the underlying structure of the product and the risks involved.

Additionally, investors should be aware of the potential drawbacks of combining insurance and investment. For example, investment-linked insurance policies may come with higher fees and charges, as the insurer is providing both insurance coverage and investment management.

Investors may also be limited in their investment options and may not have as much control over their investment decisions. It is important to carefully review the terms and conditions of any insurance and investment products before making a decision.

GroMo is an app that gives you access to many financial products, which you can sell and earn by becoming a GroMo partner with us.

KEY TAKEWAYS

-

Investment-linked insurance policies and insurance investment plans are popular options for individuals looking to achieve multiple financial goals, as they combine the benefits of insurance and investment.

-

Insurance companies invest their premiums in a range of assets, and insurance investment management focuses on maximizing investment returns while managing risk.

-

It is important to understand the difference between insurance and investment, as they are two separate financial products with different purposes.

-

Investors should carefully review the terms and conditions of any insurance and investment products before making a decision, as there may be higher fees and charges and limited investment options.

-

Consulting with a financial advisor is recommended before making any investment decisions, as they can provide guidance on financial goals, risk tolerance, and investment horizon.