How to Open Demat Account Online: In 7 Easy Steps

Learn the easy steps to open a Demat account online and discover the charges associated and documents required for opening a Demat account.

In India, only 3% of the population participates in the world's top-performing stock market.

To start trading online, you need a Demat account online, and it's simpler than you might think. With shares being traded online, the process of opening a Demat account is easy and can be done in just a few steps.

In this blog, we'll guide you through the essential steps of how to open a Demat account.

Thanks to the GroMo, this once daunting task is now easily achievable, and opening a demat account is a crucial step for anyone looking to kickstart their financial growth through stock market investments.

What is a Demat Account?

'Demat' signifies the conversion of physical securities into electronic format, making holding, transferring, and transacting securities hassle-free.

A Demat Account, short for the dematerialized account, is a game-changer for investors. Demat Account lets you hold various securities, including IPOs, Bonds, Government Securities, Mutual Funds, and ETFs, all in electronic form.

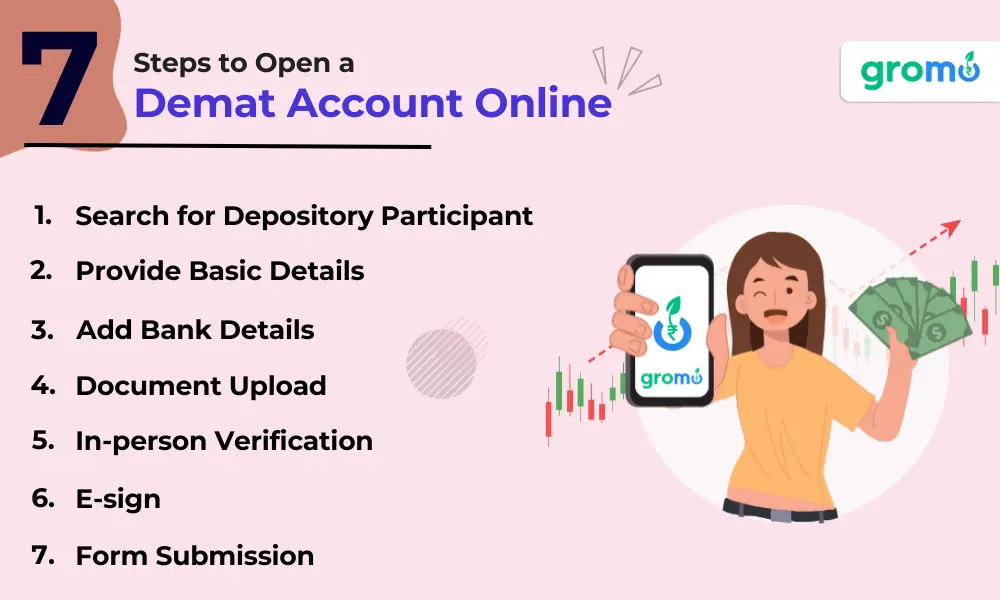

How to Open a Demat Account Online?

Opening a Demat account has never been more convenient. You can complete the entire process from the comfort of your home, right on your mobile phone.

Opening a demat account takes just 10 to 15 minutes.

Here are 7 simple steps to guide you through the process of opening a demat account:

Step 1: Look for a Depository Participant: Start by researching and choosing a Depository Participant (DP) of your preference with whom you want to open a demat account. Popular DPs in India include banks and stockbrokers.

Step 2: Enter your Basic Details: Visit the DP's website and fill out the account opening form. You'll need to provide personal information like your name, contact details, PAN card, Aadhaar card, and more. The information has to be correct if you wish to move forward in the demat account opening process.

Step 3: Enter your Bank Details: Enter your bank account information, including the account number and IFSC code. This is essential for seamless fund transfers through your demat account.

Step 4: Upload your Documents: Scan and upload the required documents. These typically include identity proof, address proof, PAN card, and a passport-sized photograph.

Step 5: In-Person Verification: Some DPs might require in-person verification to open a demat account. A representative from the DP may visit your location or you may have to visit their office for this step.

Step 6: E-Signature: Complete the electronic signature process. This is usually done through a One-Time Password (OTP) sent to your registered mobile number.

Step 7: Submission of your Form: After fulfilling all requirements, submit the application form for opening a demat account. Your DP will review the application, and upon approval, you'll receive your Demat account details.

Remember to carefully read the terms and conditions of the DP and understand any associated charges or fees.

Opening a Demat account online is a user-friendly and efficient process, providing easy access to the world of securities trading.

Charges Associated with Opening a Demat Account

Charges associated with opening a Demat account, cover the following points:

-

Account Opening Fee:

This is a one-time Demat account opening fee charged by the Depository Participant (DP) for setting up your Demat account. The amount of opening demat accounts varies among different DPs. -

Annual Maintenance Charges (AMC):

DPs charge an AMC to maintain your Demat account. It's an annual fee and varies based on the DP and the services they offer. -

Transaction Charges:

Every time you buy or sell securities, you'll incur transaction charges. These charges depend on the type and volume of transactions. -

Debit Transaction Fee:

If you transfer shares from your Demat account to another account, a debit transaction fee might be applicable. -

Pledge Charges:

If you pledge your securities for a loan, there could be charges associated with this service. -

Interest on Margin Funding:

If you've taken a loan against your securities, interest applies to the borrowed amount. -

SMS and Email Alerts:

Some DPs charge for providing SMS and email alerts regarding your account activities. -

Conversion Charges:

If you convert physical shares into electronic format, there might be fees for this conversion. -

Nomination Charges:

Charges related to nominating a person to handle your Demat account in case of your absence.

It's crucial to thoroughly understand these charges before opening a Demat account to avoid any surprises in the future.

Different DPs have different fee structures for opening a demat account, so it's wise to compare them on GroMo and choose the one that suits your financial plans.

Why do you Need to Open a Demat Account?

Opening a Demat account is essential for investors to buy, sell, and hold securities like stocks, bonds, and mutual funds in electronic form.

You need to open a Demat account because it enables you to open a Demat account, facilitates paperless transactions, and safeguards your investments.

A Demat account is crucial for the following key reasons:

-

Safe Storage: The Demat account provides secure electronic storage for stocks, bonds, and other financial securities, reducing risks associated with physical certificates.

-

Efficient Trading: Demat accounts are essential for seamless stock market transactions, making buying and selling quick and convenient.

-

Online Management: You can access, track, and manage your investments online in real time with a demat account.

-

Ownership Proof: A Demat account serves as evidence of your ownership, simplifying the tracking of your holdings.

-

Dematerialization: Many companies issue securities only in electronic form, necessitating a Demat account for holding these assets.

In summary, opening a Demat account is essential for anyone looking to invest in securities, trade in the stock market, or hold financial assets in electronic form, providing security, ease of access, and streamlined financial management.

Documents Required to Open Demat Account

You will be pleased to find that the necessary documentation is quite minimal for opening a demat account.

This convenience greatly benefits retail investors, allowing them to open a Demat account effortlessly, anytime and from anywhere.

These documents are the ones that SEBI, the regulatory authority, requires and sets as the standard.

To open a Demat account, you'll typically need the following documents:

-

Proof of Identity (PoI):

Any government-issued photo ID card, such as an Aadhaar card, Passport, Voter ID, or Driver's License. -

Proof of Address (PoA):

Documents like an Aadhaar card, Passport, Voter ID, utility bills (electricity, water, gas), or a bank statement displaying your current address. -

PAN Card (Permanent Account Number):

Your PAN card is essential for tax purposes and is linked to your Demat account. -

Passport-sized Photographs:

Recent passport-sized color photographs for account verification. -

Bank Proof:

A canceled check or a bank statement with your name and account number to link your bank account for transactions. -

Income Proof:

This may be required by some institutions for opening certain types of accounts or trading in derivatives. -

Additional Documents:

Depending on the Depository Participant (DP) or the broker, you might be asked for additional documents or information.

Ensure that the documents you provide are valid, up-to-date, and match the details you provide in your demat account opening application.

The specific requirements may vary slightly depending on the DP and regulatory changes.

Always check with your chosen DP or broker for the most up-to-date requirements before opening a Demat account.

Also, Check these out

Things to Remember While Opening a Demat Account

Before you start opening a Demat account, remember these important details.

Nowadays, many brokers offer both Demat and trading accounts as a package. However, if you're just interested in opening a Demat account, you must also open a separate trading account.

Then, you need to link this trading account with your Demat account. This link is crucial because it allows you to buy and sell shares through your Demat account.

So, to get started, focus on opening a Demat account and make sure to link it to a trading account for seamless share transactions.

Certainly, here are the key considerations when opening a Demat account, focusing on the most crucial aspects:

-

Choose a Reliable Depository Participant (DP): Select a reputable DP or brokerage firm with good customer service and a competitive fee structure.

-

Account Types: Determine the type of Demat account that suits your needs, such as an individual, joint, or corporate account.

-

Brokerage Fees and Charges: Before you open a demat account understand the fee structure, including demat account opening charges, annual maintenance fees (AMC), and transaction charges.

-

Linked Bank Account: Ensure you have a bank account linked to your Demat account for smooth fund transfers.

-

Security Measures: Maintain strong security practices to safeguard your account and investments, including password security and data protection.

-

Documentation: Prepare and submit all necessary documents, ensuring they are accurate and up-to-date.

These considerations are fundamental to opening a Demat account, ensuring that your investments are secure, cost-effective, and well-managed.

Key Takeaways:

- A Demat account is a digital wallet for holding and managing financial securities like stocks, making trading and investments efficient.

- You need a Demat account to electronically hold and trade stocks and other financial securities, simplifying investment and trading.

- To open a Demat account online, choose a reliable broker, complete the application, submit the required documents, and verify your identity online.

- Opening a Demat account involves fees like account opening charges, annual maintenance fees (AMC), and transaction charges for trading.

- For opening a Demat account, you typically need documents like proof of identity, proof of address, PAN card, photographs, bank proof, and income proof.

- When opening a Demat account, consider the DP's reputation, fees, service quality, nomination, and security measures to make informed decisions.