How To Invest In Mutual Funds: Step By Step Guide

Our comprehensive blog covers everything you need to know about these investment vehicles, including how they work.

Investing in mutual funds can be a lucrative way to grow your wealth over time. Whether you're a beginner or an experienced investor, this comprehensive guide will provide you with detailed insights on how to invest in mutual funds effectively.

From understanding the basics of mutual funds to selecting the right funds for your investment goals, we will cover all the essential aspects of mutual fund investing.

So, let's dive in!

Understanding Mutual Funds

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, and other financial instruments.

They are managed by professional fund managers who make investment decisions on behalf of the investors.

Investors in mutual funds own units or shares of the fund, which represent their proportionate ownership in the underlying securities.

Now you can sell mutual funds and many other financial products on GroMo app.

Why Invest in Mutual Funds?

-

Diversification: Mutual funds offer diversification, which helps spread investment risk across different securities, reducing the impact of individual security's performance on the overall portfolio.

-

Professional Management: Mutual funds are managed by experienced fund managers who have in-depth knowledge of the financial markets and make investment decisions based on research and analysis.

-

Affordability: Mutual funds allow investors to start with small investments, making it accessible to a wide range of investors.

-

Liquidity: Mutual funds are highly liquid, allowing investors to buy or sell units on any business day, providing flexibility in managing investments.

-

Transparency: Mutual funds are required to disclose their portfolio holdings and performance regularly, providing transparency to investors.

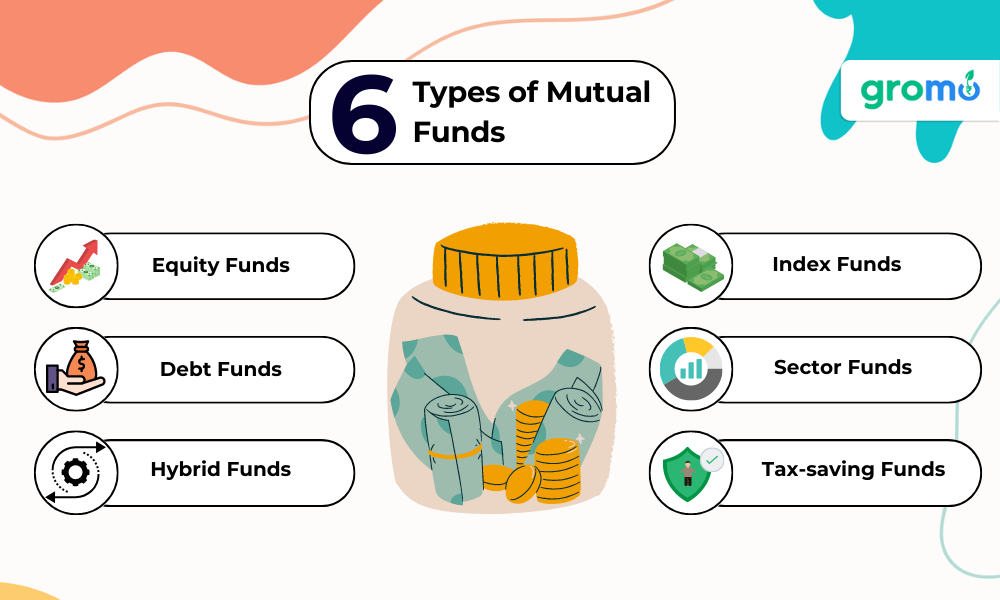

Types of Mutual Funds

-

Equity Funds: These funds primarily invest in stocks of companies and are suitable for long-term capital appreciation.

-

Debt Funds: These funds invest in fixed income securities like bonds and are suitable for conservative investors looking for regular income and capital preservation.

-

Hybrid Funds: These funds invest in a mix of equity and debt securities, providing a balanced approach to risk and return.

-

Index Funds: These funds aim to replicate the performance of a particular stock market index, providing passive investing at a lower cost.

-

Sector Funds: These funds invest in a specific sector or industry, such as technology, healthcare, or energy, providing exposure to a particular segment of the market.

-

Tax-saving Funds: These funds, also known as Equity Linked Saving Schemes (ELSS), provide tax benefits under Section 80C of the Income Tax Act in addition to potential capital appreciation.

ALSO CHECK OUT!!

- Investment Insurance: What Is Investment Insurance?

- Benefits Of Demat Account: 5 Benefits That You Should Know

- Health Insurance: What Is Health Insurance?

- Personal Loan: What Is Personal Loan?

How to Invest in Mutual Funds

Step 1: Define Your Investment Goals

Start by identifying your investment objectives, such as wealth creation, retirement planning, or saving for a specific financial goal.

Consider your risk tolerance, time horizon, and financial situation to determine the right investment goals.

Step 2: Choose the Right Type of Mutual Funds

Based on your investment goals, select the appropriate type of mutual funds that align with your risk tolerance and time horizon.

Consider factors such as historical performance, expense ratio, fund manager's track record, and portfolio composition while evaluating mutual funds.

Step 3: Research and Select Mutual Funds

Conduct thorough research on different mutual funds using reliable sources, such as fund fact sheets, prospectuses, and financial websites.

Evaluate key parameters like past performance, risk-adjusted returns, expense ratio, portfolio holdings, and fund manager's expertise.

Step 4: Open a Mutual Fund Account

To invest in mutual funds, you need to open a mutual fund account with a registered mutual fund house or through an online platform.

Provide necessary details such as personal information, bank account details, and KYC (Know Your Customer) documents to complete the account opening process.

Step 5: Invest in Mutual Funds

Once your mutual fund

account is opened, you can start investing in mutual funds by following these steps:

-

Lump Sum Investment: If you have a lump sum amount to invest, you can directly invest in mutual funds by selecting the funds of your choice and specifying the investment amount. You can either invest online through the mutual fund house's website or through a registered online mutual fund platform.

-

Systematic Investment Plan (SIP): SIP is a popular mode of investing in mutual funds where you can invest a fixed amount periodically, such as monthly or quarterly. SIP allows you to invest regularly and systematically, regardless of market conditions, which helps in averaging out the cost of investment. You can set up SIP online through your mutual fund account or online platform.

-

Systematic Transfer Plan (STP): STP is a strategy where you can transfer a fixed amount from one mutual fund scheme to another within the same fund house. This can be useful if you want to gradually transfer your investments from a debt fund to an equity fund or vice versa. STP can be set up online through your mutual fund account or online platform.

-

Systematic Withdrawal Plan (SWP): SWP is a strategy where you can withdraw a fixed amount periodically from your mutual fund investments. This can be useful if you want to receive regular income from your investments. SWP can be set up online through your mutual fund account or online platform.

Investing in mutual funds can be a rewarding way to achieve your investment goals. By understanding the basics of mutual funds, choosing the right type of funds, conducting thorough research, opening a mutual fund account, and investing systematically, you can start your mutual fund investment journey with confidence. Remember to monitor and review your investments regularly, stay informed, and seek professional advice when needed. Happy investing!

Frequently Asked Questions (FAQs)

Can I invest in mutual funds online?

Yes, you can invest in mutual funds online through the mutual fund house's website or through registered online mutual fund platforms. Many mutual fund houses and financial institutions offer online investment platforms that make it easy and convenient to invest in mutual funds.

Do I need a demat account to invest in mutual funds?

No, you do not need a demat account to invest in mutual funds. Mutual funds are held in electronic form, and you can invest in them directly without the need for a demat account. However, if you choose to invest in mutual funds through the stock exchange platform, you may need a demat account.

What is the minimum investment amount for mutual funds?

The minimum investment amount for mutual funds varies depending on the fund house and the type of mutual fund. It can range from as low as Rs. 100 to Rs. 5,000 or more. Some mutual funds also offer the option of investing through Systematic Investment Plans (SIP), which allows you to start with a smaller amount

There are several types of mutual fund schemes available to cater to different investment objectives and risk profiles. Some common types of mutual fund schemes include:

-

Equity Funds: These funds invest primarily in stocks of companies, with the aim of providing long-term capital appreciation. They carry a higher risk but also have the potential for higher returns.

-

Debt Funds: These funds invest in fixed income instruments such as bonds, debentures, and government securities, with the aim of providing regular income and capital preservation. They are generally considered less risky than equity funds.

-

Hybrid Funds: These funds invest in a mix of both equity and debt instruments, with the aim of providing a balance between capital appreciation and regular income. They can be categorized as conservative, balanced, or aggressive, depending on the allocation between equity and debt.

-

Money Market Funds: These funds invest in short-term debt instruments such as commercial papers, treasury bills, and certificates of deposit, with the aim of providing liquidity and safety of capital. They are considered low-risk and suitable for short-term investments.

If you're looking for a platform to sell and earn through many other financial products GroMo is your answer!!

DOWNLOAD GROMO

- Sector-specific Funds: These funds invest in specific sectors or industries, such as technology, healthcare, or banking, with the aim of capitalizing on the growth potential of those sectors. They carry higher risks and are suitable for investors with a higher risk appetite.

These funds, also known as Equity Linked Saving Schemes (ELSS), invest primarily in equities and offer tax benefits under Section 80C of the Income Tax Act. They have a lock-in period of three years and can help in saving taxes while providing the potential for higher returns.

What is the ideal time horizon for investing in mutual funds?

The ideal time horizon for investing in mutual funds depends on your investment goals, risk tolerance, and financial situation. In general, mutual funds are considered suitable for long-term investments due to their potential for higher returns over time.

It is recommended to have an investment horizon of at least 3-5 years for equity funds and 1-3 years for debt funds. However, it is important to carefully assess your financial goals and risk tolerance before determining the ideal time horizon for your mutual fund investments.

Can I invest in multiple mutual funds at the same time?

Yes, you can invest in multiple mutual funds at the same time to diversify your investment portfolio. Diversification is a strategy that helps spread the risk by investing in different asset classes, sectors, or regions. By investing in multiple mutual funds with different investment objectives and risk profiles, you can reduce the impact of any one fund's performance on your overall portfolio.

How do I select the right mutual fund for my investment portfolio?

Selecting the right mutual fund for your investment portfolio requires careful consideration of various factors, such as your investment goals, risk tolerance, time horizon, and fund performance.

Here are some steps you can follow:

Define your investment goals: Determine your financial goals, such as wealth creation, retirement planning, or saving for a specific purpose, and align your mutual fund investments accordingly.

Assess your risk tolerance: Understand your risk tolerance, which refers to your ability and willingness to bear risks, and choose mutual funds that match your risk profile. Equity funds generally carry higher risks, while debt funds are comparatively less risky.

Evaluate fund performance: Review the historical performance of the mutual funds you are considering, including their returns over different time periods, risk-adjusted performance, and consistency of performance. Look for funds that have a track record of delivering consistent returns and have performed well in varying market conditions.

What are the costs associated with investing in mutual funds?

There are several costs associated with investing in mutual funds, including:

Expense Ratio: This is the annual fee charged by the mutual fund for managing the investments, expressed as a percentage of the net assets of the fund. It includes the fund manager's fees, administrative expenses, and other costs.

A lower expense ratio is generally better, as it directly impacts the returns earned by investors.

Load Charges: Some mutual funds charge load fees, which are fees paid by investors when buying or selling units of the fund. Load fees can be either front-end loads, charged when purchasing units, or back-end loads, charged when redeeming units. Load charges can vary, and some funds may be "no-load" funds, which do not charge any load fees.

Transaction Charges: Some mutual funds charge transaction fees, also known as entry or exit loads, for buying or selling units of the fund.

These charges are separate from load charges and may apply in addition to the expense ratio.

Taxes: Depending on the type of mutual fund and the holding period, investors may be liable to pay taxes on their capital gains. Equity-oriented funds held for more than one year qualify for long-term capital gains tax, while debt-oriented funds held for more than three years qualify for long-term capital gains tax. Short-term capital gains are taxed at the applicable income tax rates.

Other Charges: There may be other charges such as custodian charges, transfer agent charges, etc., that are borne by the mutual fund and indirectly impact the investor's returns.

It's important to carefully consider the costs associated with investing in mutual funds and understand how they can impact your overall returns.

Also check out-

- How To Apply For A Personal Loan With Low CIBIL Score?

- How To Improve CIBIL Score Using Your Credit Card?

- How To Apply For A Home Loan With Low CIBIL Score?

- Best Selling Credit Cards in India

How can I monitor the performance of my mutual fund investments?

You can monitor the performance of your mutual fund investments through various means:

Regular review: Review the performance of your mutual funds regularly, preferably at least

quarterly or semi-annually. You can track the fund's returns, compare them with its benchmark and peers, and assess if it is meeting your investment goals.

Fund's website and reports: Most mutual funds have their own websites where you can access information about the fund's performance, portfolio holdings, expense ratio, and other important details. You can also download the fund's annual and semi-annual reports, which provide comprehensive information about the fund's performance, portfolio changes, and other relevant information.

Fund factsheets: Fund factsheets are concise documents that provide key information about the fund's performance, asset allocation, top holdings, and other relevant details. These are usually available on the fund's website or can be obtained from your mutual fund distributor.

Online investment platforms: Many online investment platforms provide tools and resources to monitor the performance of your mutual fund investments. These platforms may offer features such as performance tracking, portfolio analysis, and alerts to help you stay updated on your investments.

News and research portals: Stay updated with news and analysis related to the mutual fund industry, market trends, and economic developments. There are several financial news websites and research portals that provide insights and analysis on mutual fund performance and market trends.

Consult with a financial professional: If you are not comfortable monitoring your mutual fund investments on your own, consider seeking advice from a qualified financial professional who can help you assess the performance of your investments and make appropriate recommendations.

KEY TAKEAWAYS

-

Identify and understand your financial goals, risk tolerance, and investment horizon.

-

Diversify your investments across different asset classes, sectors, and geographic regions.

-

Research and choose the right mutual funds based on performance, expense ratios, and fund manager's track record.

-

Monitor and review your investments periodically to stay aligned with your financial goals.

-

Stay disciplined and patient, avoiding impulsive decisions based on short-term market fluctuations.