Best Instant Loan: 5 Best Instant Loan Options

Instant loans can be a game-changer in today’s world. These 5 best instant loan options will fulfill your need for urgent cash.

“Timely return of a loan makes it easier to borrow a second time.”

— Chinese Proverb

In today's fast-paced world, having access to instant loans can be a real game-changer. Whether you need emergency funds or want to seize a lucrative opportunity, instant loans provide quick and convenient financial assistance.

In this blog, we will explore the 5 best instant loan options available in the market, factors to consider when choosing the best instant loan, key features and benefits of an instant loan, and much more.

Understanding Instant Loans

Instant loans, also known as quick loans or fast cash loans, are short-term loans that provide immediate access to funds. These loans are typically processed quickly, allowing borrowers to receive the money within a short period, sometimes even within a few hours

They are designed to address urgent financial needs and are often unsecured, meaning no collateral is required. These loans offer convenience, speed, and flexibility, making them a popular choice for individuals seeking immediate financial assistance.

To sell this product, and many other financial products, Download GroMo. Using the GroMo App you can sell and earn a substantial income sitting at home.

5 Best Instant Loan Options

1. Payday Loans:

Payday loans are a popular form of instant loans that provide short-term financing to bridge the gap between paychecks. These loans are typically repaid in full on the borrower's next payday, making them suitable for immediate financial needs.

2. Personal Loans:

Personal loans are another common type of instant loan that can be used for various purposes, such as medical expenses, debt consolidation, or home improvements. They offer a higher loan amount and longer repayment terms compared to payday loans.

3. Cash Advances:

Cash advances allow borrowers to withdraw cash from their credit cards instantly. It should be noted, that cash advances usually carry higher interest rates and higher fees.

4. Peer-to-Peer Loans:

Peer-to-peer lending platforms have gained popularity in recent years, connecting borrowers directly with individual lenders. These platforms facilitate instant loans by streamlining the borrowing process and offering competitive interest rates.

5. Online Installment Loans:

Online installment loans provide borrowers with the flexibility of repaying the loan amount in fixed monthly installments over a specific period. These loans are convenient and offer larger loan amounts than payday loans or cash advances.

Also Check Out:

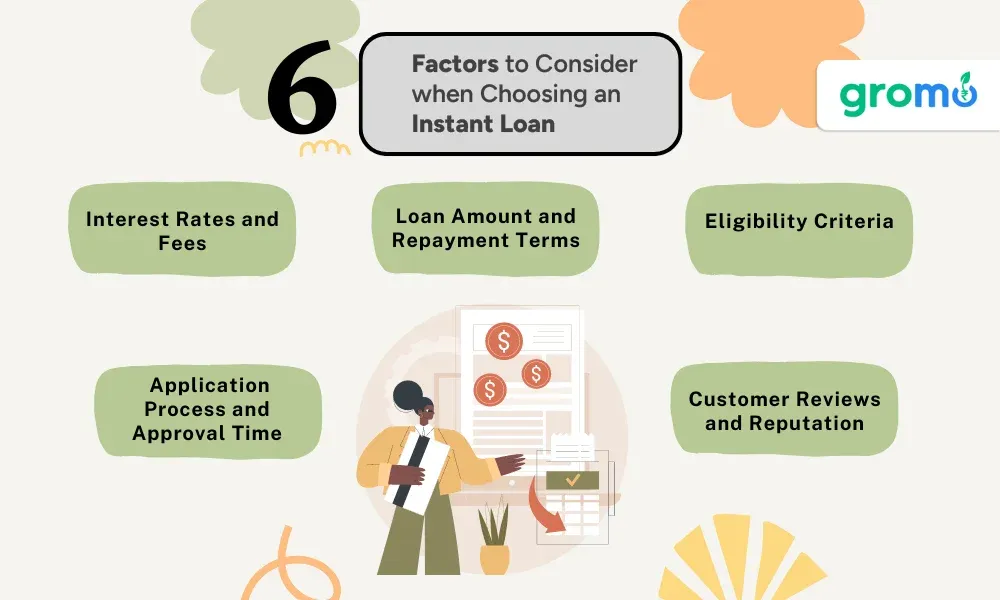

Factors To Consider When Choosing An Instant Loan

Applying for an instant loan online is not something to be taken lightly when it comes to personal finance. When selecting the best instant loan option for your needs, consider the following factors:

1. Interest Rates and Fees:

Compare the interest rates and fees offered by different lenders to ensure you get the most affordable option. Look for transparent pricing structures and avoid lenders with excessively high-interest rates or hidden charges.

2. Loan Amount and Repayment Terms:

Evaluate the loan amount you need and ensure the lender offers sufficient funds. Additionally, consider the repayment terms and choose a lender that provides flexible repayment options aligned with your financial capabilities.

3. Application Process and Approval Time:

Opt for lenders with a streamlined and user-friendly application process. Quick approval and disbursal times are crucial when seeking the best instant loan, so choose lenders that prioritize efficiency.

4. Eligibility Criteria:

Check the qualification criteria of each lender to make sure you eligible. Some lenders may have strict criteria, such as a minimum credit score, while others may be more inclusive.

5. Customer Reviews and Reputation:

Consider the feedback and reviews from existing customers to gauge the reputation and reliability of the lenders. Look for lenders with positive customer reviews and a good reputation for excellent customer service.

When it comes to finding the best instant loan options, it's crucial to consider factors such as interest rates, loan amounts, repayment terms, application process, eligibility criteria, and customer reviews.

By carefully evaluating these aspects, you can make an informed decision and choose the best instant loan option that suits your financial needs and preferences.

Remember, instant loans can be a helpful tool in times of financial urgency, but it's essential to borrow responsibly and ensure you can comfortably repay the loan within the specified terms. Always read the terms and conditions thoroughly and clarify any doubts before committing to an instant loan.

With these 5 best instant loan options outlined in this article, you can now embark on your journey to secure the funds you need quickly and efficiently. Make sure to conduct thorough research and choose a reputable lender that offers competitive rates, flexible terms, and excellent customer service.

In addition to the factors mentioned above, utilizing online comparison tools can be immensely helpful in finding the best instant loan option. These tools allow you to compare multiple lenders side by side, considering various parameters such as interest rates, loan amounts, repayment terms, and customer reviews.

By using these tools, you can easily identify the lenders that meet your specific requirements and make an informed decision.

1. Additional Features and Benefits:

Apart from the essential factors, consider any additional features or benefits offered by the lenders. Some lenders may provide additional perks such as flexible repayment options, the ability to increase the loan amount in the future, or even loyalty programs that reward customers for timely repayments.

These features can add value to your borrowing experience and make a particular lender more appealing.

2. Customer Support and Assistance:

When dealing with financial matters, having access to reliable customer support is crucial. Look for lenders who offer responsive customer service and assistance throughout the loan application and repayment process.

Whether you have queries, or concerns, or need guidance, having a supportive customer support team can make your borrowing experience smoother and more satisfactory.

3. Transparency and Trustworthiness:

Transparency is key when choosing the best instant loan. Opt for lenders who provide clear and concise information about their terms, fees, and policies. Avoid lenders who use deceptive tactics or have a history of misleading practices.

Trustworthiness is vital when dealing with financial transactions, so prioritize lenders with a reputation for integrity and honesty.

4. Responsible Borrowing Practices:

While instant loans offer convenience and quick access to funds, it is essential to practice responsible borrowing. Before taking out a loan, evaluate your financial situation, and determine if borrowing is necessary and affordable. Borrow only the amount you genuinely need and ensure you can comfortably repay it within the agreed-upon terms.

Responsible borrowing helps maintain your financial stability and protects you from falling into a cycle of debt.

By conducting thorough research, analyzing the available options, and making an informed decision, you can secure the best instant loan that meets your financial needs while ensuring a smooth borrowing experience. Remember, selecting a reliable and trustworthy lender is crucial to protect your financial well-being.

*Looking for an app for earning online?

GroMo is your answer!

Now earn with each sale by selling various kinds of financial products*

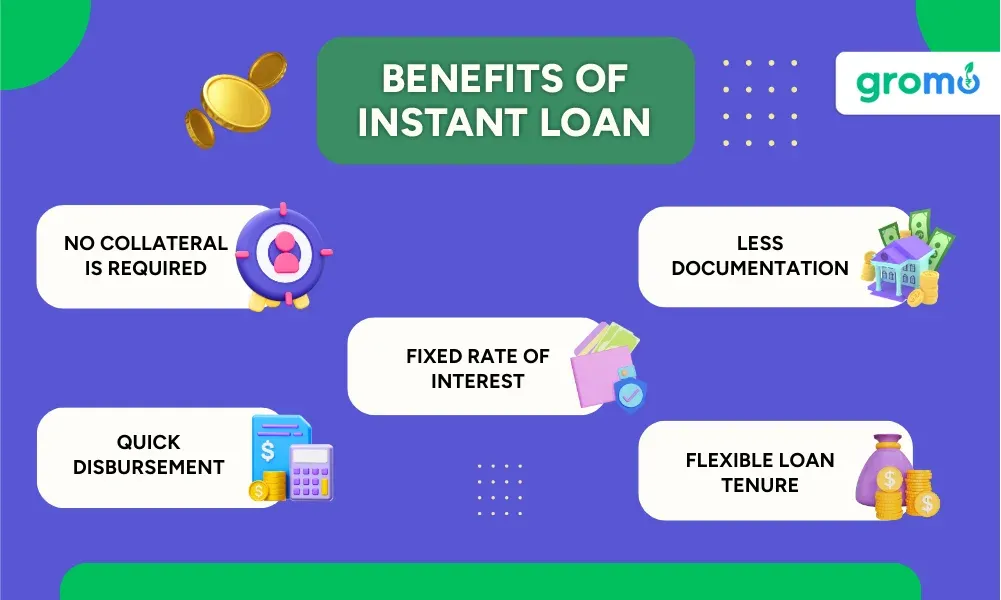

Key Features And Benefits

1. Quick Approval and Disbursement:

One of the primary advantages of instant loans is the fast approval and disbursal process. Borrowers can receive funds within a few hours or even minutes after submitting their loan application.

2. Flexibility in Loan Amounts:

Instant loans typically offer a range of loan amounts, allowing borrowers to choose the sum that matches their specific financial needs.

3. Minimal Documentation:

Compared to traditional loans, instant loans require minimal documentation, reducing the time and effort involved in the application process.

4. Convenient Application Process:

Instant loans can be applied online, from the comfort of your home or office, eliminating the need for in-person visits to banks or financial institutions.

5. No Collateral Requirement:

Many instant loans are unsecured, meaning they do not require collateral to secure the loan amount. This makes them accessible to a broader range of individuals who may not have significant assets to pledge as security.

Applying For The Best Instant Loan

1. Researching Lenders:

Before applying for an instant loan, it is essential to research and compare different lenders. Consider factors such as interest rates, repayment terms, fees, customer reviews, and the lender's reputation to make an informed decision.

2. Checking Eligibility Criteria:

Each lender will have specific eligibility criteria that borrowers must meet to qualify for an instant loan. Common requirements include age, income stability, credit score, and citizenship or residency status. Ensure that you meet these criteria before proceeding with the application.

3. Gathering Required Documents:

While instant loans generally require minimal documentation, it is crucial to gather the necessary documents beforehand to expedite the application process. Common documents include identification proof.

Also Check Out:

Key Takeaways

- Instant loans offer quick and convenient access to funds, making them an ideal solution for urgent financial needs.

- There are various types of instant loans available, including payday loans, personal loans, cash advances, peer-to-peer loans, etc.

- When applying for an instant loan, it is crucial to research and compare different lenders.

- Eligibility criteria for instant loans vary among lenders.

- While instant loans provide quick access to funds, it is essential to use them responsibly.

The information provided by us on our website or App ("Platform") is for general informational purposes only and is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the Site or our mobile application.