Benefits Of Term Life Insurance: Top 9 Benefits

Discover the financial security term insurance can provide. Learn about the benefits of this valuable policy in our informative blog. Read now!

“If You Want To Succeed In Insurance Sales, Then Stop Selling Products! Instead, Help People To Find A Solution To Their Problems!”

- Lew Nason

Term life insurance is a type of life insurance that provides coverage for a set period. If the policyholder dies during the term of the policy, its beneficiary receives a death benefit equivalent to the sum insured under the policy. Term life insurance is a popular choice for those who want to provide financial protection for their loved ones in case of unexpected death.

In this blog, we're going to disucss the benefits of term life insurance and group life insurance, tax benefits* that can be availed by buying a term life insurance.

So, let's get started!

What Are The Benefits Of Term Life Insurance?

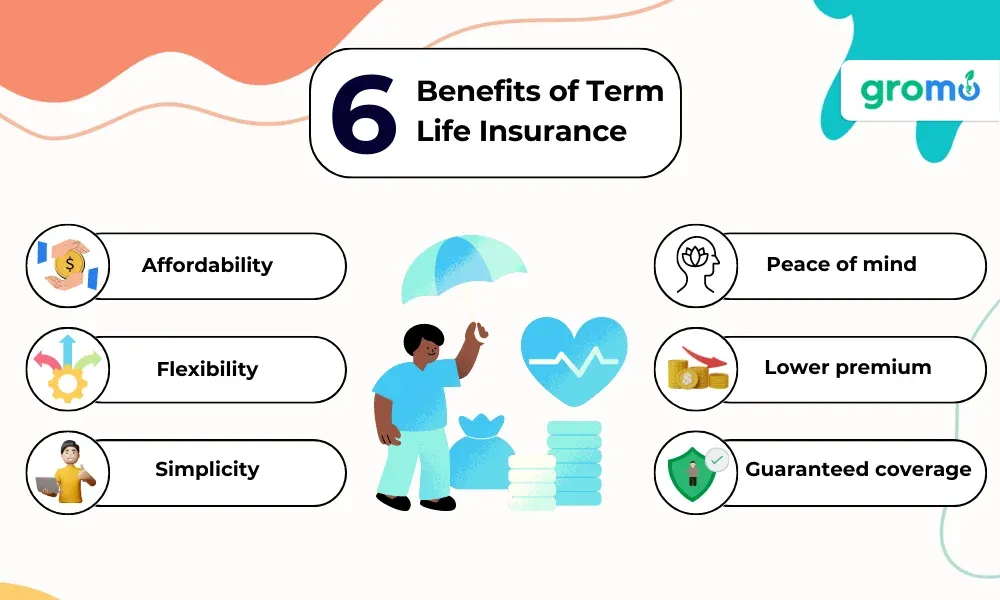

Term life insurance has 9 major benefits. Listed below are all the 9 benefits of term life insurance:

- Affordability

- Flexibility

- Simplicity

- Peace of mind

- Tax advantages

- Lower premiums

- No medical exam required

- Guaranteed coverage

- Employer contributions

You can learn more about term life insurance, sell more financial products, and earn a substantial income with GroMo Insure, a brand under Vitrak Insurance Brokers Private Limited.

Now, let's understand the benefits of term life insurance in detail:

1. Affordability

Term life insurance is typically affordable than other types of life insurance, such as endowment life insurance or ULIP plans. This is because term life insurance only provides coverage for a term that you chose, so the premiums are lower.

2. Flexibility

Term life insurance policies are very flexible. Policyholders can choose the length of the term (usually 10, 20, or 30 years, etc.), the amount of the death benefit (sum insured), and the premium payment schedule as per their choice. This allows individuals to customize their coverage to fit their specific needs and budget.

3. Simplicity

Term life insurance is very simple to understand as there are no complicated investment options or cash value accumulation features, which tend to make other types of life insurance confusing.

4. Peace of Mind

One of the most significant benefits of term life insurance is the peace of mind it provides. Knowing that your loved ones will be financially protected in case of unexpected death can be a huge relief.

Also Check Out: Term Insurance v/s Life Insurance

Tax Benefits Of Term Life Insurance*

In addition to the benefits of term life insurance listed above, term life insurance also attracts some tax benefits for Indian Nationals. Here are some of the ways that term life insurance can be tax advantageous:

1. Tax-Free Death Benefit

The death benefit paid to the beneficiary of a term life insurance policy is tax-free as per the Income Tax Act 1961 and other applicable provisions. This means that the beneficiaries will not have to pay income taxes on the amount they get

2. Tax Deduction Under Section 80C

Under Section 80C of Income Tax Act 1961, as amended from time to time, you can claim a deduction of up to ₹1.5 lakh against the premium(s) paid on your term insurance policy.

Group Term Life Insurance And Its Benefits

Group term life insurance is a type of life insurance that is offered to a group of people under a single policy, such as group term life insurance for employees of a company as a part of employee benefits provided to them.

Here are some of the benefits of group term life insurance:

1. Lower Premiums

Group term life insurance is generally less expensive than individual term life insurance. This is because the risk is spread out among a group of people, which can result in lower premiums for each individual.

2. No Medical Exam Required

Group term life insurance typically does not require a medical exam as underwriting requirements are much less stringent. This can be beneficial for those who have pre-existing medical conditions or who may have difficulty obtaining individual life insurance.

3. Guaranteed Coverage

Group term life insurance policies usually offer guaranteed coverage, which means that people in the group get coverage regardless of their health status.

4. Employer Contributions

In many cases, employers pay part or all of the premiums for group term life insurance policies. This can be a valuable employee benefit and can help attract and retain top talent.

Things To Consider For Buying Term Life Insurance

It's important to note that while term life insurance can be a great choice for many people, it may not be the best option for everyone. For example, if you have a significant amount of debt or dependents who will need long-term financial support, you may want to consider a permanent life insurance policy that provides coverage for your entire life.

So, when deciding the coverage of your term life insurance, make sure to ask yourself: How much coverage do I need?

The death benefit of your term life insurance policy should be enough to cover your outstanding debts, your dependents' living expenses, and any other financial obligations you may have. When buying term life insurance, it's a good idea to get quotes from multiple providers and compare the coverage and premiums.

An experienced insurance agent who has detailed knowledge about the insurance policies can guide and help you find the right policy in accordance with your needs. Overall, term life insurance can be an important part of a comprehensive financial plan.

By providing a death benefit to your beneficiaries in case of unexpected death, term life insurance can help ensure that your loved ones are financially secure and able to maintain their standard of living.

When choosing a term life insurance policy, it's important to carefully review the terms of the policy and understand any limitations or exclusions that may apply. Additionally, it's important to understand that life insurance policies, including term life insurance, are legal contracts that come with specific terms and conditions.

In addition to understanding the terms and conditions of your policy, it's also important to regularly review your coverage and make any necessary updates or changes. Life events such as marriage, the birth of a child, or the purchase of a home can all affect your life insurance needs.

Regularly reviewing and updating your coverage can help ensure that your policy continues to meet your needs as your life circumstances change. One important consideration when purchasing term life insurance is the length of the term.

Term life insurance policies typically come in terms of 10, 20, or 30 years, although other term lengths may be available. When purchasing term life insurance, it's also important to choose the right premium payment schedule. Premiums may be paid on an annual, semiannually, quarterly or monthly basis.

Choosing a payment schedule that fits your budget can help ensure that you can maintain your coverage over the entire term of the policy.

Go Check Out: LIC Policy: Secure Your Future With LIC Policies In 2024

It's important to understand that several factors can influence the cost of term life insurance premiums. Some of these factors include:

1. Age: Younger individuals typically pay lower premiums than older individuals.

2. Health: Your health status can affect your premiums. Individuals who are in good health pay lower premiums than those with pre-existing medical conditions.

3. Gender: Premium for women are low as compared with that of men.

4. Smoking: Insurance companies charges higher premium from smokers as compared to non-smokers.

5. Occupation: Certain occupations may be considered riskier depending on the nature of work that may result in higher premiums.

When applying for term life insurance, it's important to disclose any pre-existing medical conditions or other risk factors that may affect your coverage or premiums. Failing to disclose this information could result in your policy being voided or your beneficiaries being denied the death benefit.

It's also important to understand that term life insurance can be used in a variety of estate planning strategies. For example, term life insurance can be used to:

1. Provide For Loved Ones: The death benefit from a term life insurance policy can be used to provide financial support for your loved ones in case of unexpected death.

2. Pay Off Debts: A term life insurance policy death benefit can be used to settle debts, such as home mortgages or credit card debts.

3. Fund Education: The death benefit from a term life insurance policy can be used to fund education expenses for your children or grandchildren.

4. Equalize Inheritances: If you have multiple children or beneficiaries, the death benefit from a term life insurance policy can be used to equalize inheritances.

When using term life insurance in an estate planning strategy, it's important to work with an experienced attorney or financial advisor to ensure that your plan is structured in the most effective and tax-efficient way.

Finally, it's important to understand that life insurance policies, including term life insurance, are designed to provide financial protection in case of unexpected death. They are not intended to provide investment returns or accumulate cash value.

It's worth noting that term life insurance policies can also come with optional riders that can provide additional coverage or benefits of term life insurance.

Some common riders include:

1. Accelerated Death Benefit Rider: This rider allows you to access a portion of the death benefit in case of a terminal illness or medical condition that significantly shortens your life expectancy.

2. Waiver Of Premium Rider: This rider allows you to opt out of premium payments in the event of a disabling condition that limits your ability to work and make a living.

3. Children's Rider: This rider provides coverage for your children in case of their unexpected death. The coverage amount is typically a small fraction of the death benefit for the primary insured.

4. Return Of Premium Rider: This rider allows you to get your premiums back if you survive the life of your policy.

Know more about term life insurance and sell many other financial products now with GroMo Insure.

Key Takeaways

-

Term life insurance provides a low-cost option for securing financial protection for your loved ones in case of your unexpected death.

-

It offers flexibility in terms of coverage duration and amount, allowing you to tailor the policy to meet your specific needs.

-

Term life insurance has no cash value or investment component, which means you pay only for the coverage you need.

-

It can help cover expenses such as mortgage payments, college tuition, etc. that your loved ones may be responsible for in your absence.

-

Purchasing term life insurance when you are young and healthy can help lock in lower premiums and provide peace of mind.

**Standard Disclaimer: The information provided by us on our website or App (""Platform"") is for general informational purposes only and is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the Site or our mobile application.

For more product-related information, please read the sales brochure carefully before concluding a sale. Standard Terms and Conditions Apply | Gromo Insure is a brand under Vitrak Insurance Brokers Private Limited | Direct Broker (Life & General) | IRDAI Registration No – 826 | Registration Code – IRDAI/DB875/2021 | Valid till 18-06-2025| Reg. Address – Flat – 7, Plot No. 103, Himversha Apartment, Patparganj, New Delhi, East Delhi, Delhi – 110092| Correspondence Address – 3rd Floor, BLM Towers, Plot 63, Sector 44, Gurgaon | CIN – U66000DL2021PTC377736